If you’re facing wage garnishment or debt collection that threatens your essential income, you may be asking, “How do I file a claim of exemption?” Here’s the answer.

To file a claim of exemption, submit the appropriate “Claim of Exemption” form to the court where the judgment was issued, include details about your exemptions, and serve a copy to the judgment creditor and any relevant parties within the required time frame.

Filing a Claim of Exemption allows you to request that the court protect a portion or all of your income due to financial hardship or certain protected categories, like supporting dependents. Filing correctly and on time is crucial to safeguard your earnings.

With decades of experience helping clients protect their income from garnishment, our team at DebtBusters knows the garnishment process inside and out. Below, we’ll walk you through each step of filing a Claim of Exemption to ensure your income remains protected.

Step 1 – Review Your Eligibility for a Claim of Exemption

Not everyone qualifies for a Claim of Exemption, so the first step is to determine whether you meet your state’s eligibility requirements. Each state has different rules governing income exemptions, so reviewing local guidelines can help you understand what protections are available.

Common Eligibility Criteria

- Financial Hardship: If garnishment causes financial strain that affects your ability to meet basic needs, you may qualify.

- Dependent Support: Income needed to support dependents, such as children or elderly parents, may be protected.

- Specific Exemptions: Certain types of income, like Social Security, veterans’ benefits, and disability payments, are often exempt from garnishment.

Understanding your eligibility helps you establish the basis for your claim and improves your chances of success.

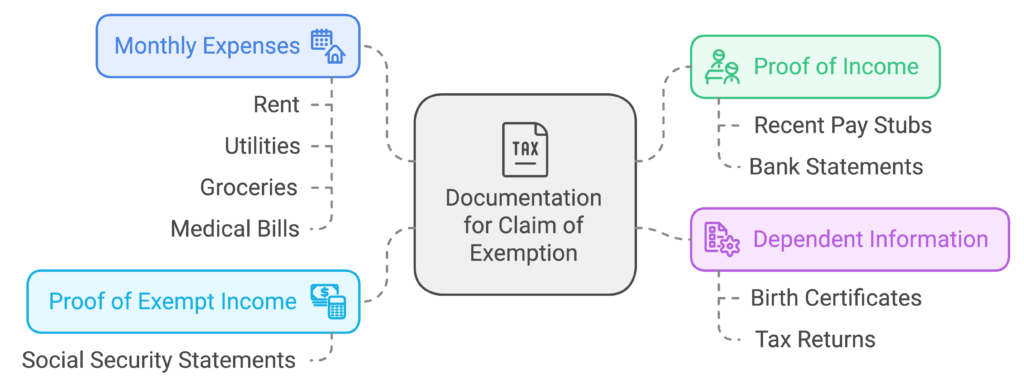

Step 2 – Gather Documentation to Support Your Claim

Once you determine your eligibility, gather documentation that demonstrates your financial situation and any applicable exemptions. Proper documentation is crucial for proving your need for protection.

Documents to Prepare

- Proof of Income: Recent pay stubs or bank statements showing your earnings.

- Monthly Expenses: A detailed list of essential expenses, such as rent, utilities, groceries, and medical bills.

- Dependent Information: Documentation showing support for dependents, such as birth certificates or tax returns.

- Proof of Exempt Income: Documents showing sources of income that are legally exempt, such as Social Security benefit statements.

Having all relevant documents ready will make it easier to complete the form accurately and support your case when submitting your Claim of Exemption.

Step 3 – Obtain the Claim of Exemption Form

Visit your local courthouse or check your state’s judicial website to obtain the specific Claim of Exemption form required in your jurisdiction. Many states provide downloadable forms, along with instructions on how to complete them.

How to Find the Form

- Visit your state or county court’s website and navigate to the forms section.

- Search for “Claim of Exemption” or “Exemption Claim for Wage Garnishment” forms.

- Download and review the form and any instructions provided to ensure accuracy.

Having the correct form is essential, as using the wrong form or omitting important fields can delay your case or result in a denied claim.

Step 4 – Complete the Claim of Exemption Form

Once you have the correct form, carefully fill it out, providing detailed information about your financial situation, income sources, and reasons for requesting an exemption.

Information to Include on the Form

- Personal Information: Your name, address, and contact information.

- Case Information: The case number, court name, and creditor details as listed on your garnishment notice.

- Income and Expenses: A clear breakdown of your monthly income and essential expenses to demonstrate financial hardship.

- Exemption Details: Specify the income or assets you are seeking to exempt and provide the reason for the exemption, such as dependent support or hardship.

Completing the form accurately is crucial. Double-check all information to ensure that every section is filled out and that your financial situation is clearly represented.

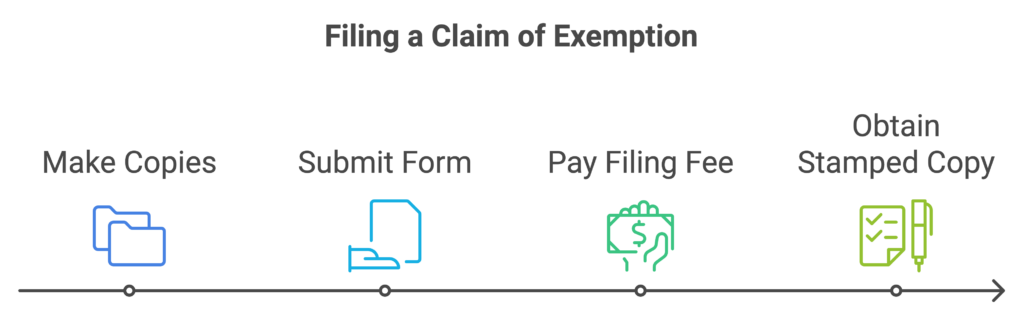

Step 5 – File the Claim of Exemption with the Court

After completing the form, submit it to the court that issued the garnishment order. Some states require you to submit additional copies, so check your local court’s filing rules.

How to File Your Claim

- Make several copies of your completed Claim of Exemption form.

- Submit the original form to the court, along with any required copies and supporting documents.

- Pay any applicable filing fee (or request a waiver if you qualify).

- Obtain a stamped copy from the court clerk as proof of submission.

Submitting your Claim of Exemption on time is essential. Most states have strict deadlines, often within five to ten days of receiving the garnishment notice.

Step 6 – Notify Your Creditor and Employer

Once you file the Claim of Exemption with the court, notify your creditor and, if applicable, your employer. They need to be aware that you have filed for exemption to avoid or pause wage garnishment while your claim is under review.

Steps to Notify the Creditor and Employer

- Send a copy of your Claim of Exemption form to the creditor listed on the garnishment notice.

- Notify your employer if your wages are being garnished, so they are aware of the pending exemption claim.

- Keep copies of all notifications for your records.

Notifying the creditor and employer ensures they are informed about your claim and helps prevent further garnishment while awaiting the court’s decision.

Step 7 – Attend the Court Hearing, If Required

In some cases, the court may schedule a hearing to review your Claim of Exemption. This hearing is an opportunity for you to explain your financial situation and why the exemption is necessary.

What to Expect at the Hearing

- Bring Documentation: Have copies of your Claim of Exemption, supporting documents, and any additional paperwork that explains your financial situation.

- Present Your Case: Be prepared to explain how the garnishment impacts your ability to cover essential expenses and why the exemption is necessary.

- Decision: The judge may make a decision during the hearing or notify you by mail regarding the outcome.

Attending the hearing and being prepared with documentation strengthens your case and increases your chances of a favorable decision.

Comparing Claim of Exemption Grounds

Different grounds for filing a Claim of Exemption offer varying levels of protection. This table summarizes common reasons for filing and the documentation required to support each claim.

| Exemption Grounds | Description | Supporting Documents |

|---|---|---|

| Financial Hardship | Garnishment prevents meeting basic needs | Pay stubs, list of monthly expenses |

| Dependent Support | Income needed for family support | Tax returns, birth certificates |

| Exempt Income (e.g., Social Security) | Legally protected income source | Benefit statements, proof of income type |

| State-Specific Exemptions | Varies by state (e.g., retirement income) | State exemption forms, income verification |

Reviewing this table can help you determine the best approach to completing your Claim of Exemption form and provide the right evidence for each exemption.

Take Control of Your Income by Filing a Claim of Exemption

If wage garnishment or debt collection is putting your essential income at risk, a Claim of Exemption can help protect what you need to support yourself and your family. By following these steps and filing your claim accurately and on time, you can improve your chances of gaining relief from garnishment.

For expert guidance on protecting your income and navigating garnishment, contact DebtBusters at (866) 223-4395. Our experienced team is here to help you safeguard your financial future.

Frequently Asked Questions

What is a Claim of Exemption and how does it help with garnishment?

A Claim of Exemption is a legal filing that requests the court protect a portion of your income from garnishment, typically due to financial hardship or dependent support. If approved, it can reduce or stop wage garnishment, allowing you to keep more of your earnings.

Who is eligible to file a Claim of Exemption?

Eligibility varies by state but generally includes individuals facing financial hardship or those who rely on their income to support dependents. Certain income types, such as Social Security or disability benefits, are often exempt from garnishment.

What documents are needed to file a Claim of Exemption?

You typically need proof of income, a list of monthly expenses, and any documents supporting your claim, such as statements showing exempt income (e.g., Social Security) or evidence of dependent support.

How long do I have to file a Claim of Exemption after receiving a garnishment notice?

Most states have a strict deadline, typically between five to ten days from the date you receive the garnishment notice. Filing promptly is essential to ensure the court reviews your claim before further garnishment occurs.

Will filing a Claim of Exemption stop garnishment immediately?

Filing a Claim of Exemption does not guarantee an immediate stop to garnishment, but it may pause garnishment until the court reviews your claim. Notify your creditor and employer of your filed claim to help prevent immediate garnishment.

Do I need a lawyer to file a Claim of Exemption?

A lawyer is not required, but having legal assistance can improve your chances, especially if you are unsure about your eligibility or need help gathering documents. Many legal aid organizations offer assistance with filing Claims of Exemption.

What happens if my Claim of Exemption is denied?

If your claim is denied, garnishment will likely continue. You may still have other options, such as negotiating with the creditor or exploring alternative debt relief solutions. Consulting a financial expert can help you determine your next steps.