In today’s economic landscape, managing debt can be a significant challenge for many. As you find yourself juggling multiple credit card bills, loan payments, and other financial obligations, you might wonder about strategies to regain control of your finances.

Two popular options that often come up in such discussions are debt consolidation and debt settlement. While they might sound similar, they serve different purposes and have unique implications for your financial health. Understanding these differences is crucial for choosing the right solution for your situation.

What Is Debt Consolidation?

Debt consolidation is a financial strategy that involves combining multiple debts into a single loan with one monthly payment. This can be achieved through a personal loan, a balance transfer credit card, or a home equity loan.

How It Works

When you consolidate your debt, you essentially take out a new loan to pay off existing debts. The primary goal is to streamline payments and reduce the interest rate to make managing monthly financial obligations more manageable. Here’s a step-by-step breakdown:

- Evaluate Your Debts: List all your debts, their interest rates, and monthly payments.

- Choose a Consolidation Method: Depending on your credit score and available options, decide whether a personal loan, balance transfer, or home equity loan suits your needs.

- Apply and Pay Off Debts: Once approved, use the loan to pay off all existing debts, leaving you with just the new loan to handle.

By reducing your monthly payments and possibly lowering your interest rate, debt consolidation helps make your financial situation more predictable and manageable.

What Is Debt Settlement?

Debt settlement, on the other hand, involves negotiating with creditors to pay less than the full amount owed. This option is generally pursued when you are unable to manage your debt payments and are at risk of defaulting.

How It Works

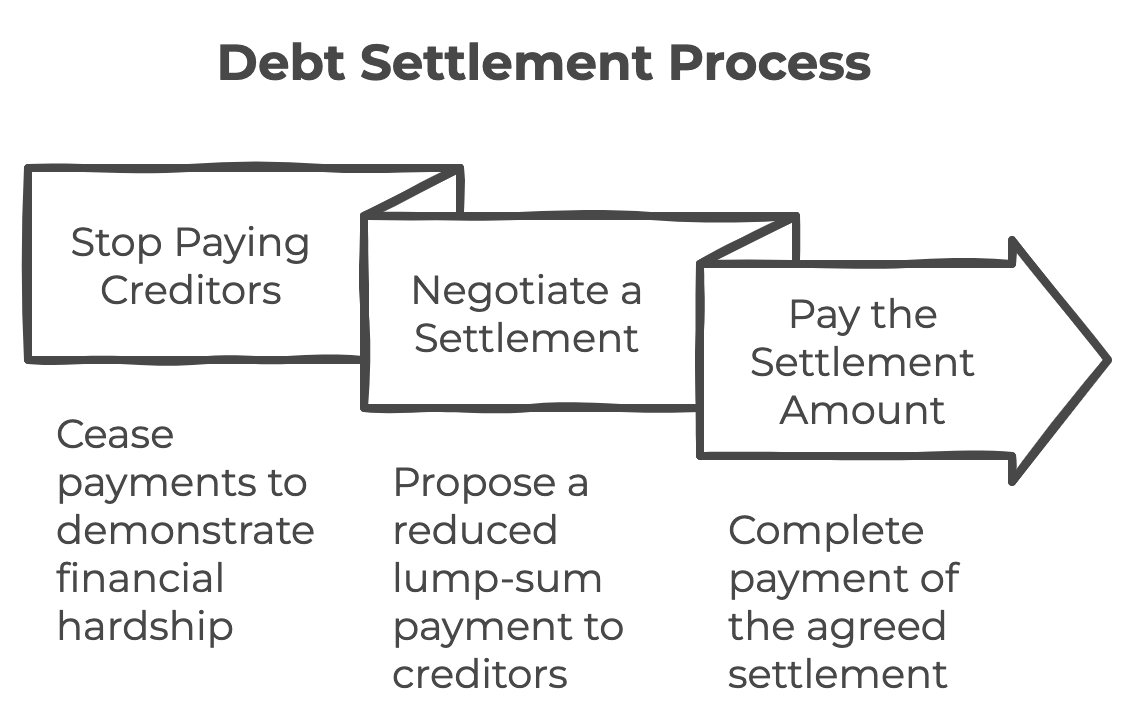

Debt settlement is typically handled through a third-party company, though some individuals may choose to negotiate independently. Here’s a simplified process:

- Stop Paying Creditors: To show creditors that you’re unable to make payments, you stop sending payments. This strategy can hurt your credit score significantly.

- Negotiate a Settlement: With the help of a settlement company, you offer a lump-sum payment that is less than the total owed, ideally convincing creditors to forgive the remaining debt.

- Pay the Settlement Amount: Once a settlement is reached, you pay the agreed amount, effectively resolving the debt.

While debt settlement might allow you to pay less than owed, it can negatively impact your credit score and remain on your credit report for years.

Key Differences Between Debt Consolidation and Debt Settlement

It’s vital to understand the core differences to determine which is best for your financial health:

- Impact on Credit Score:

- Debt Consolidation usually has a lesser negative impact since it involves paying off debts in full through a new loan.

- Debt Settlement can significantly drop your credit score due to missed payments and the settlement appearing on your report.

- Financial Implications:

- Consolidation aims to lower the total interest paid over time, though the total principal remains the same.

- Settlement reduces the principal itself, which can lead to tax liabilities on the forgiven amount.

- Time Frame:

- Consolidation may extend the loan term, resulting in lower monthly payments.

- Settlement can be quicker if a lump-sum payment is possible; however, negotiations can take time.

Choose the Right Path to Financial Freedom Today

Debt doesn’t have to define your future. Whether debt consolidation or debt settlement is the right solution for you, DebtBusters is here to help you make an informed decision and regain control of your finances.

Call us now at 866-223-4395 or visit DebtBusters.com to schedule your free consultation. Our experienced professionals will guide you through your options and create a personalized plan to help you achieve lasting financial freedom.

Your journey to a debt-free future starts with a single step—take it with DebtBusters today.

Conclusion

Both debt consolidation and debt settlement offer paths to debt relief, but they apply to different circumstances and have distinct outcomes. If your struggle with debt is primarily due to high interest rates and multiple monthly payments, debt consolidation might be your best bet. However, if you are genuinely unable to meet your financial obligations, debt settlement might provide the necessary relief, despite its consequences.

Ultimately, careful consideration and possibly consulting a financial advisor will guide you toward the option that aligns best with your financial goals and circumstances.

Related Content: