Table of Contents

Are you looking to file bankruptcy but not sure where to start?

This guide will tell you everything you need to know before you start your bankruptcy. We will guide you through every step of the process from when you should start to what it costs all the to preparing you to file.

Don't have time to read the entire guide now?

Fill out the form for a downloadable PDF version of the guide you can reference later.

Chapter 1 What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy in many ways resembles what people envision bankruptcy doing, wiping away old debts without requiring any payment of those debts. Chapter 7 is also known as liquidation bankruptcy or straight bankruptcy, and it is important for people to keep in mind that filing for Chapter 7 could require having to part with several valuable personal assets.

The major issue in many Chapter 7 cases will be passing the bankruptcy means test, which is used to determine whether a person who is filing for Chapter 7 has the means to repay some of their debts. When a person cannot pass the means test, they either need to file for Chapter 13 or have their case dismissed.

Qualifying for Chapter 7

The main qualification for Chapter 7 is the means test, which begins with examining your current monthly income, or the gross income in the six months preceding your application for bankruptcy times two. You compare your figure with the state median, and a person who makes less than the median passes, while a person who makes more will have to try another step.

A person can deduct monthly expenses to determine their disposable income, and Chapter 7 is less possible for people with higher disposable incomes. The United States Department of Justice website has more information about means testing.

The means test involves the following three forms found on the United States Bankruptcy Court’s website:

- Form 122A-1. Chapter 7 Statement of Your Current Monthly Income (Form 122A-1) determines whether a person’s income is below their state’s median income. When it is, they automatically qualify for Chapter 7 and do not need to fill out the other two forms.

- Form 122A-2. Chapter 7 Means Test Calculation (Form 122A-2) lets you deduct allowed expenses and determine whether you have sufficient disposable income to pay into a Chapter 13 bankruptcy plan.

- Form 122A-1Supp. Certain people, such as disabled veterans, reservists, or members of the National Guard, may be exempted from a presumption of abuse, meaning they do not take the means test at all.

Chapter 7 Debts

The most common kinds of debts people may be able to discharge through Chapter 7 bankruptcy include, but are not limited to:

- Medical bills

- Personal loans

- Credit card balances

- Business debts

- Collection agency accounts

- Medical bills

- Past due rent

- Unsecured payday loans

- Mortgage or automobile loans (although creditors can reclaim houses or vehicles)

- Utility bills

- Old tax penalties

- Civil court judgments

- Social Security overpayments

- Veterans’ assistance loans and overpayments

While there are certainly a number of attractive areas that Chapter 7 can provide unparalleled relief with, there are also certain areas in which filing Chapter 7 is going to mean nothing. Chapter 7 is not going to change your status in any of the following kinds of cases:

- Child support

- Spousal maintenance

- Income taxes within the past three years

- Student loans

- Court fees

- Government-imposed fines or penalties

- Personal injury or wrongful death damages

- Debts owed for pension plans or condominium fees

- Debts not dischargeable in prior bankruptcies

In addition to the means test, an applicant will also need to satisfy a credit counseling requirement. After you file for Chapter 7, you will meet the trustee assigned to your case, and the trustee will call for a meeting of the creditors.

There can be numerous counseling sessions for debtors, but people who complete all of the steps in Chapter 7 will then move towards a discharge of their debts, under which debtors are relieved from personal liability for most debts and creditors owed debts are prohibited from taking any further collection actions. The United States Bankruptcy Court states that individual debtors receive a discharge in more than 99 percent of chapter 7 cases.

Chapter 7 Misconceptions

The most troubling problem for many people is that Chapter 7 will automatically mean that a person filing must relinquish all of their personal property rights. Nothing could be further from the truth.

A trustee is not going to take your automobile when you need it to get to and from work. While there could be a possibility of you needing to sell your home, it is all a matter of determining which property is exempt as opposed to being nonexempt.

Some of the most common kinds of nonexempt assets that people may have to part with include:

- Vacation homes or other residential property that is not your primary residence

- Newer motor vehicles

- Expensive musical instruments you do not need for work

- Valuable stamp or coin collections

- Antique furniture

- Cash, bank accounts, stocks, bonds, and other investments outside of retirement accounts

- Valuable artwork

- Expensive clothing

- Family heirlooms

- Designer shoes or handbags

- Jewelry

Exempt assets usually include motor vehicles up to certain values, furniture, household goods, and clothing, tools necessary for a profession, retirement accounts, any damages from a personal injury case, and public benefits.

Chapter 2 What Happens When You File Chapter 7 Bankruptcy in Arizona?

While Chapter 7 bankruptcy can certainly be a process that allows people to feel a real sense of financial freedom, there are still all kinds of issues people can encounter that can make the experience a little disconcerting. Before you can become overjoyed with debt relief, you may have to deal with more than a few things that you would rather not have dealt with at all.

The good news is that most people are able to complete the necessary steps to get a Chapter 7 petition finalized. While many people will have concerns about their nonexempt property being seized immediately after filing, most people keep several kinds of nonexempt property.

Preparing to File for Chapter 7

Arizona requires people filing for bankruptcy to complete credit counseling from a United States Trustee-approved credit counseling agency and receive their credit counseling certificate. If a person does not complete credit counseling before they file their petition or does not meet the requirements of an extension to complete counseling after filing, their case can be dismissed without refund of any filing fee paid, they do not receive a discharge of their debts, and if they refile within one year after dismissal, automatic stay protection under the bankruptcy code from creditors will be limited to 30 days.

A bankruptcy court can only allow a person to complete a course after filing if they meet all of the necessary conditions, which are them having tried to get credit counseling from an approved agency before bankruptcy but were not able to obtain the counseling during the 7-day period after they made the request, exigent (emergency) circumstances existed that made it necessary for them to file their case immediately, and they filed a certification stating the facts regarding the first two conditions with their petition. The United States Department of Justice has a list of approved providers of personal financial management instructional courses.

You also need to avoid any suspicious activities before you file for bankruptcy. In other words, do not go on any major shopping trips where you accumulate massive debt you do not intend to repay, as this will often lead to creditors objecting to any discharge based on fraud.

Also do not think about trying to conceal assets, as courts can always figure out when people are trying to hide certain possessions. This can lead to seizure of assets and also criminal charges.

Filing for Chapter 7

You will file your Chapter 7 bankruptcy petition, schedules, and other forms with the local bankruptcy court. All of the paperwork should make clear your debts and monthly living expenses, income and earnings, exempt property you can keep and nonexempt property the Chapter 7 trustee can sell for creditors, and any gifts, sales, or other property transactions occurring up to 10 years before filing.

After you file for bankruptcy, a notice of your filing is sent to all of your creditors. There will also be an invitation to a meeting of the creditors in accordance with section 341 of the United States Bankruptcy Code.

The court issues an automatic stay as soon as you file that prevents creditors from engaging in any further collection efforts. This can mean that filing Chapter 7 immediately stops wage garnishment, bank levy, or loss of utility services.

Determining Property in Chapter 7

The trustee assigned to your Chapter 7 case is responsible for the management of your estate and ensuring that creditors are able to recover as much money as possible. A trustee can earn more for themselves by recovering more for the creditors.

Trustees typically review property listed in Chapter 7 paperwork and designate the items for which exemptions might allow people to keep property but try to sell everything else of value. People in Chapter 7 cases may have to give up certain valuables, but there can still be exemptions that allow them to keep more than they might have initially feared.

Secured Debt in Chapter 7 Cases

While much of the debt in most Chapter 7 cases will be unsecured debts, which are the debts that do not require collateral. Many people filing for Chapter 7, however, have secured debts for items they want to keep, such as homes or motor vehicles.

In these types of cases, people may have to redeem or reaffirm assets they intend to keep. By signing a reaffirmation agreement, you can continue to make payments on an existing automobile loan without worrying about adverse consequences of your bankruptcy filing.

The Chapter 7 Discharge

After about six months, your Chapter 7 case should be ready for discharge. The discharge often states that all of your unsecured debt is wiped out and creditors have no grounds for pursuing any more money from you.

The discharge only applies to certain debts, so you want to make sure you speak to an attorney so you can understand exactly which debts the court is agreeing to wipe out.

Chapter 3 How Much Does It Cost To File Chapter 7 in Arizona?

The main reason many people are filing for bankruptcy is that they do not have money, so it can be difficult for the same people to comprehend how they are supposed to pay hundreds of dollars just to file for bankruptcy. When you are struggling to afford the costs of filing bankruptcy, make sure you are working with an experienced Arizona bankruptcy attorney who can help you explore all of your financial options.

Before people can file for bankruptcy, they must take an approved credit counseling course, and then they have to pay filing fees. People may be able to get many of these fees waived in some cases.

Credit Counseling Fee Waivers

Costs for credit counseling courses can vary depending on the provider, but most courses are around $50. When you are registering with a credit counseling agency, you are usually asked if you would like a fee waiver, and you should answer yes when this question is posed.

You may have to submit a formal application, proof of income, and a completed budget worksheet. Most of the questions on your application will relate to your income and your family size.

After you complete your application and related materials, it typically takes about 72 hours to get a response as to whether you qualify for a fee waiver. When the fee is waived, you can take the class for free, but people who are not approved may have to reapply.

Bankruptcy Filing Fee Waivers

Filing a bankruptcy case under Chapter 7 involves paying a fee of $338 with either a money order or a cashier’s check, as filing fees cannot be paid with credit cards. People are supposed to pay the full fee when they file their bankruptcy petitions, but people who cannot pay the full fee when they file have options.

People whose income is below 150 percent of the federal poverty guidelines may be eligible to apply for a fee waiver. The Arizona median income standards for means test cases filed in 2022 are monthly incomes of $4,871.83 or annual incomes of $58,462.00 for households of one, monthly incomes of $6,105.17 or annual incomes of $73,262.00 for households of two, monthly incomes of $6,592.50 or annual incomes of $79,110.00 for households of three, monthly incomes of $7,478.42 or annual incomes of $89,741.00 for households of four, monthly incomes of $8,303.42 or annual incomes of $99,641.00 for households of five, monthly incomes of $9,128.42 or annual incomes of $109,541.00 for households of six, monthly incomes of $9,953.42 or annual incomes of $119,441.00 for households of seven, monthly incomes of $10,778.42 or annual incomes of $129,341.00 for households of eight, monthly incomes of $11,603.42 or annual incomes of $139,241.00 for households of nine, and monthly incomes of $12,428.42 or annual incomes of $149,141.00 for households of 10.

It is also possible to make a down payment of $80 and then file an application to pay your filing fee in installments. You can pay a filing fee in up to four installments, and you fill in the amounts you intend to pay and the dates you intend to pay them.

Hiring a Lawyer for Your Bankruptcy Case

When it comes to the costs of hiring an attorney to file your Chapter 7 case for you, the fees that lawyers charge can vary depending on the firm. In general, you can expect to pay at least $1,000 for a Chapter 7 case, with some firms charging more depending on the complexity of your case and certain other factors.

A Chapter 7 case will usually be cheaper than a Chapter 13 case for an attorney because there is much less work in Chapter 7 than there is with Chapter 13. You may be able to negotiate a single flat fee that covers your entire case, but you should always be mindful of other assorted bankruptcy costs that may arise and add even more to your bill.

When you are speaking to lawyers about your bankruptcy case, you want to not only get a better idea whether Chapter 7 or Chapter 13 will be in your best interests, but also learn more about the benefits and consequences of filing bankruptcy, how much information an attorney will need to start working on your case, and exactly which kinds of debt your bankruptcy will actually be getting rid of. You also want a lawyer to specify any property of yours that might be at risk of being taken, how long the case will take, and what challenges you should be expecting.

Chapter 4 How Long Does It Take To File Chapter 7 Bankruptcy in Arizona?

Make no mistake, Chapter 7 certainly represents the fastest possible bankruptcy case a person can file. That said, specific issues can arise that may slow down the handling of a Chapter 7 case, and you will want to be working with an Arizona bankruptcy attorney so you can be confident that you have the right answers and your case can continue moving towards a discharge.

The amount of time people invest in their bankruptcy cases can always vary by the individual because some people will exert several additional hours into researching their bankruptcy filings while others will do nothing more than call a lawyer. The timeline we will discuss here will be based on a presumption that a person wanting to file for Chapter 7 bankruptcy will contact a bankruptcy attorney to speak about their case first.

Chapter 7 Timelines

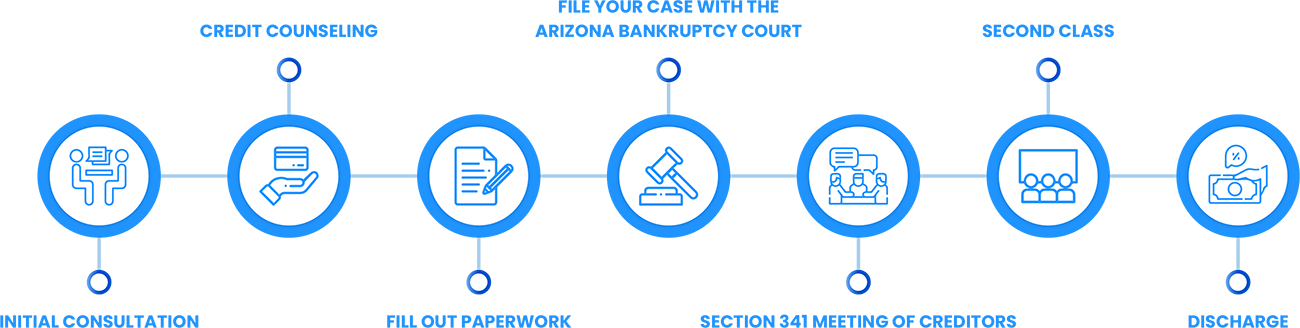

When you file for Chapter 7 bankruptcy, your case will typically break down as follows:

- Initial Consultation — Your first phone call should always be to a lawyer who specifically handles bankruptcy cases. Try to make sure you speak to an attorney at least 90 days before you file. It will be important to get a lawyer’s guidance on how you should be making purchases in the coming days because certain bills could later be used as the basis for fraud claims. Most importantly, an attorney can tell you exactly what kinds of documents they will need from you to proceed with your case, and you may have to invest several days to collect all of these documents.

- Credit Counseling — Before you can file for bankruptcy, all individual bankruptcy filers must complete pre-bankruptcy credit counseling and pre-discharge debtor education. Certificates of completion for both credit counseling and debtor education are required before a filer’s debts can be discharged, but only credit counseling organizations and debtor education course providers approved by the United States Trustee Program can issue the certificates. The credit counseling and pre-discharge debtor education may break into two classes, and you need to attend both on time because failure to attend can lead to dismissal of your petition.

- Fill Out Paperwork — You will need to fill out bankruptcy schedules and statements that are required for the Arizona Bankruptcy Court to look into your current financial status. You must provide information relating to your assets, debts, current income and monthly expenses, and summary of financial transactions before you file your case. When you hire a bankruptcy lawyer, they can usually handle all of the paperwork for you. You may need to fill out a questionnaire that provides the law firm with the information to complete the schedules and statements.

- File Your Case with the Arizona Bankruptcy Court — When you file your Chapter 7 bankruptcy case, there is a $338 filing fee although you can ask for a waiver. A person filing Chapter 7 is given a case number they can then give to their creditors, although filing Chapter 7 should immediately create the automatic stay that prohibits creditors from taking any further collection actions.

- Section 341 Meeting of Creditors — A 341 Meeting of Creditors happens about 30-45 days after a petition is filed, and a person filing for Chapter 7 must attend this hearing. An attorney can represent people but cannot appear on their behalf. The name “meeting of the creditors” causes a lot of fear in many people, but many creditors do not even bother to attend. The only thing people really have to worry about is answering a series of 10 to 15 questions from a trustee about their case, but none of the questions should be anything that catches a person off guard.

- Second Class — The second credit counseling and pre-discharge debtor education class is often scheduled for within 60 days of the Section 341 meeting. Attending this class is again mandatory.

- Discharge — When a person completes all of these steps and also honors any requests of a trustee, then they are eligible for a discharge within 60 days of their 341 hearing. It often takes courts a little longer than this to process paperwork, so be patient. In some cases, it can take up to 90 days. In the end, it usually takes about six months from the time you file for Chapter 7 bankruptcy to the date you get your discharge.

After you file for Chapter 7, you will need to immediately establish a budget that you can stick to, open a savings account with enough money to cover you in the case of a sudden emergency, and try to see if you can apply for a secured credit card that you only use on expenses you can pay off within a month. Make sure you are paying all your bills on time and also check your credit report to ensure that debts discharged in your bankruptcy do not remain on your record.

Chapter 5 How Often Can You File Chapter 7 Bankruptcy in Arizona?

Some people who have already filed for bankruptcy once before in their lives can find themselves in situations in which they need to consider filing bankruptcy. The good news is that there is no limit on the number of times you can file for bankruptcy, although there are limits on how soon you can file again after previously filing, and anybody needing help with a second or subsequent bankruptcy filing should be sure to work with an Arizona bankruptcy attorney.

You really need to make sure to take the time to fully understand the consequences of filing for bankruptcy a second or subsequent time. Once a court forgives debt, it will be a certain number of years before you can ask to have more debt forgiven.

Chapter 7 Filing Timelines

Eight Years to File Chapter After Chapter 7

Four Years to File Chapter 13 After Chapter 7

Six Years to File Chapter 7 After Chapter 13

Two Years to File Chapter 13 After Chapter 13

The wait between bankruptcy filings will depend on what kind of case you originally had and what you are attempting to file now. The time limits relate to discharges, not filings, so it is the amounts that courts have actually discharged that are relevant more than prior filings.

The wait times are generally as follows:

- Eight Years to File Chapter 7 After Chapter 7 — While Chapter 7 is often considered the quickest possible bankruptcy case, it also represents the longest wait of any time between cases. Filing again before the eight-year wait period is up will lead to a denial of a second discharge and a debtor remaining liable for all their debts.

- Six Years to File Chapter 7 After Chapter 13 — People seeking Chapter 7 protection after filing Chapter 13 must wait six years but might be able to waive the wait period if they paid their unsecured debts in full in their original Chapter 13 case or paid at least 70 percent of their plan in good faith and made their best effort to repay.

- Four Years to File Chapter 13 After Chapter 7 — In these types of cases, people may be able to work around the four-year restriction by “double filing” or “filing Chapter 20,” which is supposed to signify 13+7. The argument in these cases is that a person needs to file Chapter 13 to deal with debts their Chapter 7 filing could not discharge. Filing for Chapter 13 before the four-year wait period is up will lead to a denial of a second discharge and a debtor remaining liable for all their debts.

- Two Years to File Chapter 13 After Chapter 13 — The shortest distance between cases is also one of the least likely since the typical Chapter 13 plan takes three to five years to complete. There can be cases in which people seek new repayment plans after previous ones failed because of extreme hardship. Filing for Chapter 13 before the two-year wait period is up will lead to a denial of a second discharge and a debtor remaining liable for all debts not paid through the prior Chapter 13 plan.

For many people, there is concern about having never received a discharge on the bankruptcy chapter that was originally filed. When a court dismisses a bankruptcy case, a person can usually file again in 180 days.

People can file again relatively quickly unless they failed to obey a court order or their case was voluntarily dismissed because of a creditor filing a motion to lift an automatic stay. When a person is filing for Chapter 7 a second time after their first attempt was denied, then the clear issue will probably be an inability to get the court to honor many of the same debts listed on the first attempt.

Filing repeat bankruptcies may also reduce automatic stay protections in some cases, so you will want to consult an attorney about how much protection you will enjoy. You also need to prepare for the risk that filing multiple bankruptcies could be seen as abusive.

When you are attempting to file for Chapter 7 again, the previous bankruptcy case could negatively impact your performance in the bankruptcy means test. You also need to keep in mind that a creditor or trustee could ask to have your discharge revoked if they argue that you obtained the discharge fraudulently by concealing property or hiding records.

If a person files for Chapter 13 after receiving a Chapter 7 discharge, they may be able to catch up on debts they incurred after filing the first time. People filing for Chapter 13 twice may be able to extend their repayment plans.

Some people need to be careful, however, so they do not find themselves ineligible for a discharge or not getting adequate protection from creditors. If a judge finds they are filing cases in bad faith, it can prevent them from filing any more.

Chapter 6 What Debts Can Be Discharged in a Chapter 7 Bankruptcy in Arizona?

Chapter 7 is the most preferred option for people filing for bankruptcy because Chapter 7 simply wipes out debt without any obligation to repay. Many people are aware that Chapter 7 cannot remove all kinds of debts, and an Arizona bankruptcy lawyer can take the time to explain to you exactly which debts of yours you could expect to be discharged.

The Administrative Office of the United States Courts reports that individual debtors receive a discharge in over 99 percent of chapter 7 cases. It usually takes six months between the date a Chapter 7 petition is filed and the date the court formally discharges debt, but the wait is usually worth it.

Debts Commonly Discharged in Chapter 7

When a person files Chapter 7, they are generally seeking to have a court wipe out all of their unsecured debt, which refers to all forms of debt without collateral promised to a creditor. The most common kinds of unsecured debt discharged in Chapter 7 cases include, but are not limited to:

- past-due rent or other money owed under lease agreements

- credit card debt

- medical bills

- collection agency accounts

- personal loans from friends, family, and employers

- unpaid utility bills

- repossession or foreclosure deficiency balances

- phone bills

- business debts

- auto accident claims

- judgments from unpaid credit card debt, medical bills, or other unsecured debt

- old tax penalties and unpaid taxes

- civil court judgments

- attorneys’ fees

Just as it is important to understand what debts can be discharged in Chapter 7, it is also important to understand the debts that cannot be discharged in Chapter 7. For example, federal and private student loans are not dischargeable in bankruptcy unless a person can prove that their loan payment imposes an “undue hardship” on them, their family, and their dependents.

The truth remains that whether it is a Chapter 7 or Chapter 13 case, courts have a very high standard for what constitutes an undue hardship, and some courts may discharge a portion of a student loan in certain cases. Student loans are commonly the first type of debt that most attorneys have to inform people about because several individuals only began to explore bankruptcy options once their student loans became due.

Alimony and child support are two other kinds of debts that bankruptcy courts cannot take any action against. Child support, alimony, spousal maintenance, and spousal support are all deemed to be non-dischargeable debts in bankruptcy, but they may be reduced through Chapter 13 repayment plans.

A person also cannot discharge any debt that was incurred under false pretenses, which is a fancy way of saying things people buy without intention to pay for it. Debt incurred under false pretenses is extremely common in many bankruptcy cases because people assume they can max out the credit cards before filing, but this is always a mistake because courts frequently uncover the expenses and hold people accountable.

You should also remember how many luxury purchases you made before you decide to file for bankruptcy because debts people incur within 90 days of their bankruptcy filings for luxury goods or services worth $800 or more owed to a single creditor are nondischargeable. This is also true for cash advances of $1,100 or more taken within 70 days of a bankruptcy filing.

Unpaid taxes, such as tax liens, can also survive a bankruptcy discharge, although taxes that are several years old could be discharged. A tax lien remains attached to your property, so you will still be responsible for that after Chapter 7.

Property taxes people incur before filing for Chapter 7 are also nondischargeable. Property taxes payable more than one year before filing could be discharged, however.

You also cannot discharge employment taxes, trust fund taxes, or nondischargeable taxes. You could also remain responsible for condominium dues and fees, pension plans, and personal injury or wrongful death damages from drunk driving cases.

When people are not satisfied with the types of debt that Chapter 7 can wipe out, then it may be advisable for them to seek the help of a debt relief organization. You need to exercise extreme caution in working with any debt relief company because there are several frauds and scam artists seeking to take advantage of people.

It may be possible for you to work with a reputable debt relief company that helps you negotiate more flexible repayment terms with your creditors and help you find some financial relief that you are seeking. You could also benefit from speaking to a financial advisor in some cases.

Chapter 7 What Are The Advantages Of Filing Chapter 7 Bankruptcy in Arizona?

Many people who are actively considering filing for Chapter 7 bankruptcy have questions about the long-term effects of a bankruptcy filing and exactly how declaring bankruptcy could be advantageous. Everybody should understand that there are scores of benefits to filing for Chapter 7, and an Arizona bankruptcy attorney can take the time to speak to you about your own unique needs and what Chapter 7 could do for you.

Chapter 7 is one of the most powerful chapters of bankruptcy law because it allows debtors to discharge several kinds of debt without requiring any repayment. It can be difficult to qualify for Chapter 7, however, as people must pass a bankruptcy means test that determines whether a person has enough income to file for Chapter 13 and enter a repayment plan instead.

Common Advantages of Chapter 7

Chapter 7 is also known as liquidation bankruptcy because it discharges all of a person’s debts without any calls for repayment. A trustee in a Chapter 7 case can collect all of a debtor’s non-exempt assets to pay creditors, but people can keep the items most important to them in most cases.

As it relates to Chapter 7 bankruptcy, the advantages of filing include many considerations. Some of the most common benefits people enjoy include:

- Automatic Stay — As soon as you file for Chapter 7 bankruptcy, an automatic stay takes effect that prohibits your creditors from taking any further collection actions against you. You will want to be working with a lawyer who can ensure that your creditors will fall under the provisions of an automatic stay, as there are certain cases in which an automatic stay is not issued unless the debtor specifically obtains a court order for it, and some creditors may also seek relief from automatic stays.

- Protect Your Future Wages — Filing for Chapter 7 also means creditors can no longer threaten to garnish your future paychecks. When you file for Chapter 7, your checks become yours and yours alone to cover all of your needs.

- Exemptions — Many people worry that Chapter 7 will mean that they will have to give up several kinds of property that are valuable to them, but the truth is that people rarely have to part with anything because so much property can be declared exempt. When you work with an experienced attorney, they will know how to protect all of your belongings from trustees. You will usually keep your car too, provided that you reaffirm your agreement with your lender if you are making payments.

- Quickness — A Chapter 7 case usually only lasts a matter of months, typically not more than six. This means people can achieve complete financial relief in a much quicker time than they would under Chapter 13, which requires people to repay for three to five years.

- Improved Credit Access — Be cautious after filing bankruptcy because as soon as you file for Chapter 7, you will begin receiving countless offers to sign up for credit cards. You need to review the terms of each agreement carefully to look for outrageous fees, but you might also come across a good deal to sign up for that allows you to develop a better, more responsible spending habit.

- Options for Your Home — Chapter 7 could allow you to develop a new plan for help paying for your house. You may also have to sell the home in filing for Chapter 7, but you will be able to develop a plan for better living.

People can come up with a wide variety of reasons not to file for Chapter 7 bankruptcy, but the predominant reason in most of these cases is simple fear and people just being afraid to find out what it is like to file for bankruptcy. You should not let these kinds of common concerns prevent you from taking the steps you need to take now to address your financial future because filing Chapter 7 could allow you to take the first steps to begin rebuilding your credit record.

The Administrative Office of the United States Courts says individual debtors receive a discharge in more than 99 percent of chapter 7 cases. Even better for people filing for Chapter 7, debtors do not have to deal with their creditors anymore, as an attorney can step in and deal with all creditors while handling your case.

Chapter 8 What Is The Downside of Filing For Chapter 7 Bankruptcy in Arizona?

Just as there are undoubtedly many benefits to be found in filing for Chapter 7 bankruptcy, there can just as surely be drawbacks. You will want to be working with an Arizona bankruptcy attorney so you can know how to navigate any difficulties that might arise.

There is no getting around the fact that by filing for Chapter 7, you are openly declaring you cannot pay your debts, and you can bet that your credit report is going to reflect for several years that you declared bankruptcy. Your bankruptcy can deliver relief now but cause many additional problems in the future when you are seeking new loans.

Potential Disadvantages of Chapter 7

Filing for Chapter 7 can relieve a person of many debts, but not all debts, so a person who gets their debt discharged is still liable for paying child support, spousal maintenance, and other financial obligations unaffected by bankruptcy. In a majority of cases, bankruptcy also does nothing in terms of student loan relief.

As nice as it can be to finally stop having your creditors calling non-stop, it can also take some time to see some of the most tangible benefits of Chapter 7. Some of the other kinds of downsides to filing for Chapter 7 can include:

- Credit Impact — Filing for Chapter 7 stays on your credit report for 10 years. Your bankruptcy will be clearly stated to all future lenders.

- Loss of Property — When you file for Chapter 7, you are responsible for disclosing all of your assets, and the ones that are not exempt may be claimed by a trustee to pay your creditors.

- No Mortgage — When you do not already have a mortgage agreement that you can attempt to save during Chapter 7, it will be otherwise impossible to obtain one after filing for Chapter 7.

- Your Income — You may not be able to file for Chapter 7 if you make too much money and have too much disposable income, as a court will find such people to be eligible to file under Chapter 13 instead and enter repayment plans.

- Publicity — Your bankruptcy filing becomes a matter of public record, so anybody could be able to look up information about your case.

- Nondischargeable Debts — Chapter 7 can only get rid of certain unsecured debts, but you will remain responsible for many of your secured debts, such as automobile loans.

Another drawback to filing for Chapter 7 is that it dramatically lengthens the amount of time you will have before you can declare bankruptcy again. You must wait eight years to file for Chapter 7 again after previously getting a discharge under Chapter 7, and people must wait six years to file for Chapter 7 after filing for Chapter 13, while there is a four-year wait for filing for Chapter 13 after receiving a Chapter 7 discharge and only a two-year wait between receiving a Chapter 13 discharge and filing a new Chapter 13 case.

Incomes are often the primary source of problems in filing for Chapter 7 relief because people with higher disposable incomes are not entitled to bankruptcy protection. When courts find that people have significant incomes or more disposable income, they convert Chapter 7 cases to Chapter 13 to force people to enter repayment plans for three to five years.

Courts can have all kinds of reasons for denying a Chapter 7 discharge, including a debtor failing to produce adequate financial records, not satisfactorily explaining losses in assets, failing to obey an order of the bankruptcy court, committing bankruptcy fraud, or failing to complete a credit counseling course. The most common reasons that bankruptcy petitions get denied are failure to complete credit counseling, incomes being too high, debtors defrauding bankruptcy courts, and debts previously being discharged through bankruptcy.

Bankruptcy fraud usually involves debtors concealing their assets in an attempt to avoid forfeiture of the assets, but some people file false or incomplete forms, which may lead to perjury charges. Presumptive fraud cases usually involve people charging expensive luxury items or taking out substantial cash advances shortly before filing for bankruptcy.

There are several unintended consequences to many other kinds of cases, such as people who pay friends or family members back for private loans and find trustees seeking repayment of those amounts. There are also cases in which people file before expensive hospital stays that create significant new medical bills that will not be able to be discharged after filing.

Chapter 9 Can You File Chapter 7 Bankruptcy in Arizona on Student Loans?

The general rule of thumb in bankruptcy cases is that student loan debt cannot be discharged in Chapter 7 or even Chapter 13, so debtors should assume that they will always remain liable for those debts. The truth is actually more complicated than that, and you should work with an Arizona bankruptcy attorney when you think that your student loan debt is deserving of a discharge.

The United States Department of Education Federal Student Aid website notes that it is possible to have federal student loans discharged in bankruptcy, provided that a person files a separate action, better known as an adversary proceeding. An adversary proceeding is a kind of separate lawsuit within your bankruptcy case to determine the dischargeability of a debt.

Discharging Student Loans in Chapter 7

Can the debtor maintain a minimal standard of living for themselves and their family if forced to repay their loans?

Is the debtor's current financial situation unlikely to change during their repayment period?

Has the debtor tried to get out of paying their student loans, and can they demonstrate they made a good-faith effort to repay them?

A 2014 American Bankruptcy Law Journal study found that only 0.1 percent of student loan debtors filing for bankruptcy even try to discharge their student loans. The important catch there is that 40 percent of people who initiated adversary proceedings were able to discharge all or a part of their student loan debts.

People hoping to see evidence of court decisions relating to student loan debt in bankruptcy cases are in luck:

- In March 2016, the United States Bankruptcy Court for the District of Arizona ruled in Edwards v. Educ. Credit Mgmt. Corp. (In re Edwards), Case No: 3:14-bk-16806-PS (Bankr. D. Ariz. Mar. 31, 2016) that a debtor satisfied her burden of proof on each of the three Brunner tests and concluded that a partial discharge was not appropriate because the debtor did not have the capacity to repay any portion of her student loans, so it wholly discharged the student loans at issue under 11 U.S Code § 523(a)(8).

- In another case in January 2014, the United States Bankruptcy Court for the District of Arizona found a debtor’s loans to be dischargeable under the Brunner test.

- Another adversary proceeding in July 2013 involved a debtor representing themselves and got the United States Bankruptcy Court for the District of Arizona to rule that their student loan debt would be discharged in its entirety.

- In Greenwood v. Educ. Credit Mgmt., 349 B.R. 795 (Bankr.Ariz. 2006), the United States Bankruptcy Court for the District of Arizona ruled that a debtor satisfied all three prongs of the Brunner test and a judgment would be entered in their favor on the complaint, which stated that the debtor was entitled to a discharge of his student loan obligations which exceeded $39,000.

The phrase you might have noticed in those summaries was “Brunner test,” which is the test most states use to determine undue hardship claims. The Brunner test is a three-pronged test that simply asks:

- Can the debtor maintain a minimal standard of living for themselves and their family if forced to repay their loans?

- Is the debtor’s current financial situation unlikely to change during their repayment period?

- Has the debtor tried to get out of paying their student loans, and can they demonstrate they made a good-faith effort to repay them?

People are more likely to pass the Brunner test when they are older, are likely not to make too much money for the remainder of their lives, and have tried to pay off their loans. The test is most likely to be applied during an adversary proceeding, which begins when a complaint is filed asking the court to rule on an issue relating to a bankruptcy case.

An adversary proceeding will be given a new case number separate from the number of the associated bankruptcy case and will be governed by Part VII of the Federal Rules of Bankruptcy Procedure (FRBP). There are several actions that may be brought by an adversary proceeding, but you will want your cause to be a Proceeding to determine the dischargeability of a particular debt under § 523.

Discharging student loan debt is difficult but not impossible in Arizona, but you need to make sure you are working with a skilled attorney who can help you navigate every single step of the legal process. Retaining legal counsel will improve your own preparations for legal proceedings so you can be confident that you are presenting the strongest possible case for a student loan discharge.

Chapter 10 How Long After Chapter 7 Bankruptcy in Arizona Can You Buy a House?

Many people are aware that filing for bankruptcy will mean bad things for their credit records, but there are often questions about exactly how long somebody will have to wait to be able to buy a house after filing for Chapter 7. When you are dealing with these kinds of concerns, be sure to talk to an Arizona bankruptcy attorney about what your options can be after you file.

Nothing will permanently exclude you from consideration because you filed for bankruptcy, but it is possible that a recent filing can delay eligibility in some cases. People who want to buy homes after filing for Chapter 7 can certainly pay cash for homes to secure purchases, but many will have to rely on loans with high interest rates.

Mortgage Options After Bankruptcy

When a person wants to get a mortgage in Arizona, then they need to understand the different mortgage options and how their bankruptcy filing affects all of them. For any conventional mortgage lender, Fannie Mae and Freddie Mac requirements typically stipulate that a person cannot obtain a mortgage until four years after bankruptcy discharge or dismissal.

Conventional mortgages can be much harder to qualify for after Chapter 7, which can make government-backed mortgages insured by one of three federal government agencies a much more preferable option. The agencies include the following:

- Federal Housing Administration (FHA) — The United States Department of Housing and Urban Development (HUD) states that FHA loans have been helping people become homeowners since 1934. You need to satisfy certain minimums for an FHA home loan, including having a credit score of at least 580, have not filed for Chapter 7 bankruptcy in the last two years, you can show proof of income, you can afford a down payment, and the home you are purchasing will be your primary residence. The FHA does not make loans but instead insures loans made by private lenders, so you will have to seek out an FHA-approved lender. You then need to apply or get pre-approved for an FHA loan, and then buying a home will involve an FHA property inspection and appraisal, FHA underwriting and approval, and then you paying your closing costs and fees.

- United States Department of Agriculture (USDA) — The USDA loan program helps low- and middle-income consumers become homeowners by possibly allowing them to purchase homes with $0 down while receiving competitive interest rates and low mortgage insurance costs. Getting prequalified with a USDA lender will involve a credit check and a brief income review, as USDA determines applicants using income from every adult earner in a household. You will want to know how much you need to borrow and your household’s total monthly income before you apply. You need to find a USDA lender, and additional USDA requirements will include property needing to be a person’s primary residence, household income satisfying USDA income limits, the buyer being a United States citizen, property being in a USDA-eligible location, and the buyer having a minimum 640 FICO score. Once you are preapproved for a USDA home loan, you find a home in a USDA-eligible area and make an offer. USDA home loans go through two stages of loan approval, as all parts of your loan have to be cleared through underwriting first before USDA. Your lender and/or USDA can request additional documents or information before approval can be issued. The appraisal is a required step for final loan approval to assess property value, and a satisfactory appraisal will confirm the property values supports the purchase price. Closing occurs within a few days of final USDA approval.

- Department of Veterans Affairs (VA) — You begin the VA loan process by finding a VA-approved lender. You will have to request a VA home loan Certificate of Eligibility (COE), which requires different documentation depending on your status. You may want to try to pre-qualify for your loan before you begin home shopping, but you could also go house hunting and sign a purchase agreement. The lender will process your application and order a VA appraisal. When everything is approved, you will simply sign your final papers.

Immediately after filing for Chapter 7, you will need to take solid steps to try and restore your credit rating. While many people can be reluctant to take out credit cards, it can be beneficial to maintain a couple of credit cards that you use and pay off every month, so there is no recurring balance.

Chapter 11 Can I Keep My Car If I File Chapter 7 Bankruptcy in Arizona?

One very common reason that people are reluctant to file for bankruptcy is because of concerns about having to forfeit valuable personal property, such as a motor vehicle. The good news is that most people who file for Chapter 7 in Arizona are able to keep their cars, and an Arizona bankruptcy attorney will be able to help you complete the entire process and retain all of the items most valuable to you.

Several factors come into play when you are wondering whether a person can keep their car in a Chapter 7 case, including the value of the motor vehicle, how much a person owes on the motor vehicle, and how much of an exemption the vehicle qualifies for. People should not be terribly fearful about losing their cars in bankruptcy proceedings because most trustees and bankruptcy courts are aware that individuals need their motor vehicles to get to and from various places, such as work.

Understanding Exemptions in Arizona

Federal bankruptcy law establishes that a debtor can exempt some of their property under federal law or under the laws of their home state. A motor vehicle is an asset and is listed on Schedule A/B of bankruptcy forms, and the list of exemptions from the United States Bankruptcy Court for the District of Arizona establishes an exemption of equity in one car not greater than $6,000.

When a debtor or their dependent is physically disabled, the fair market value of the motor vehicle must not be greater than $12,000. Equity translates to the fair market value of the motor vehicle minus debt to any secured creditor.

A person who does not have an automobile loan and owns their car outright has the same amount of equity as a car’s value. A person who still has a loan determines their equity by subtracting the remaining loan amount from the actual value of the vehicle, so a person who owes $5,000 on an $8,000 car has $3,000 in equity.

A motor vehicle in Arizona will be exempt from bankruptcy proceedings when the equity is less than $6,000, and a person is filing on their own. In other words, driving a car that currently has a value of $20,000 but you still owe $15,000 on means that you have $5,000 in equity and you can keep the car.

When a car has more equity than the exemption, a trustee may be able to seize the vehicle and sell it to satisfy your debts. A trustee does not automatically decide to seize all vehicles with more equity than the exemption though, as some cases may require more effort to sell and not be worth the trustee’s time.

Any car will be considered to be a secured debt, meaning a person cannot discharge their car loan in bankruptcy. The only option people have when they are filing bankruptcy and cannot afford to continue to make car payments is to allow the lender to repossess the vehicle.

Some people may also be leasing their motor vehicles, and a car lease is a contract that will not be considered a debt when you file for Chapter 7. A person can continue to lease their car in a Chapter 7 case so long as they remain current on their payments.

If the value of your vehicle is too low, you can juice up your number by using a wildcard exemption. Arizona does not have a wildcard exemption, but federal law allows an exemption of $1,475 plus up to $13,950 of any unused amount of the homestead exemption (or a total of $15,425).

Another possible option in some cases can be redemption, under which a person keeps their vehicle by paying the fair market value of the vehicle in full. It is most useful for people who are upside down on vehicles, and some companies offer redemption loans that can be repaid like ordinary car loans.

The obvious drawback to a redemption agreement for a person filing Chapter 7 is needing to accumulate enough money to pay for the car in one fell swoop, but redemption funding providers are common, and people need to exercise severe caution in dealing with these companies. Many providers charge very high interest rates.

In the end, your three options with your car will be to reaffirm, in which you and a lender sign a reaffirmation agreement stating you will continue to make car payments, surrender, in which you give up the vehicle, or redemption, in which you pay based on the car’s value.

Chapter 12 How Long Does Chapter 7 Bankruptcy Stay on Your Credit in Arizona?

Most people who are filing for bankruptcy wonder how long filing for Chapter 7 will haunt their credit reports. The great news for all people filing bankruptcy is that there is no effort in needing to get a bankruptcy removed from your credit report because a bankruptcy will be automatically deleted 10 years after the date you file for Chapter 7.

You will want to have an Arizona bankruptcy attorney help guide you through the entire process of filing for Chapter 7 as well as what you should do afterward. In many cases, the steps people take immediately after filing for bankruptcy profoundly influence their credit scores.

How Bankruptcy Appears on Credit Reports

Reviewing Credit

Reports

Make Every

Payment

Make Every

Payment

Maintain Low Credit Utilization Ratio

Apply for a Secured Credit Card

Apply for a Secured Credit Card

Seek Authorized User Status

When a person files for bankruptcy, it is usually included in the public records section of a credit report. Some creditors may also include bankruptcy information in the account information section.

You cannot do anything to remove a bankruptcy listing from your credit report, meaning that you can only take other actions that might serve to help improve your credit score. The best steps you can take to rebuild your credit rating will include:

- Reviewing Your Credit Reports — It is always a good idea for any person who has recently filed bankruptcy to review their credit reports from all major three credit bureaus, Experian, Equifax, and Transunion. Credit reports can be important because they will allow you to verify that your debts have actually been discharged and are carrying a zero balance. It is also beneficial just to be sure every account listed actually belongs to you and is displaying the correct current payment status or open and closed dates. You can also learn more about what to do if you need to dispute an error by any credit bureau, possibly sending a dispute letter by mail, filing an online dispute, or contacting the agency by phone.

- Make All Your Payments — Few factors are as important to your credit rating as your payment history, which accounts for 35 percent of a person’s FICO credit score (30 percent is amount owed, 15 percent is the length of the credit history, 10 percent is credit mix, and 10 percent is new credit). Paying outstanding debts on time improves a credit score but making late payments or defaulting on a loan can harm the credit score.

- Maintain Low Credit Utilization Ratio — A credit utilization ratio is the sum of all a person’s balances divided by the sum of the cards’ credit limits. This means that a person who has $100,000 in credit and uses $50,000 of it has a credit utilization ratio of 50 percent. People should try to keep their credit utilization ratios at less than 30 percent, and you can rebuild your credit faster by keeping as close to 0 percent as possible.

- Apply for a Secured Credit Card — Make no mistake, you are going to get a lot of credit card offers after you file for Chapter 7 bankruptcy, and many of the deals should be ignored when they involve outrageous interest rates or other hidden fees. You are not likely to get a traditional credit card, but you could qualify for a secured credit card, which is a credit card requiring a security deposit that establishes your credit limit. You can use a secured credit card just like a traditional credit card in most cases, and you will want to pay your balance immediately at the end of every month to help improve your credit because the secured credit card company will report your payments to the three credit bureaus.

- Seek Authorized User Status — If you simply are not comfortable with the idea of taking out your own credit cards after filing for Chapter 7, you always have the option of asking a friend or family member if they are willing to add you as an authorized user on one of their cards. So long as the person you are asking has a responsible payment history, being an authorized user can also lead to an increase in credit ratings.

CNBC linked to a Debt.org article stating that people with average scores of 680 lose between 130 and 150 points in bankruptcy while above-average scores of 780 can lose between 200 and 240 points. However, people with scores in the 400s or 500s could actually experience a boost from a bankruptcy filing of as much as 50 points after filing for bankruptcy.