Medical debt is a pressing issue for many people struggling with overwhelming finances. Unexpected medical expenses can quickly accumulate, creating stress and financial strain. But can medical debt be included in debt relief programs? This blog post will explore this question in depth, guiding those seeking ways to manage their healthcare-related financial burdens.

Understanding Medical Debt

Medical debt arises from healthcare expenses that are not covered by insurance. This can include hospital bills, medical treatments, medications, and other related costs. Unlike other types of debt, medical debt is often incurred unexpectedly, making financial planning difficult for those affected.

The Challenges of Medical Debt

The nature of medical debt presents unique challenges. It can impact your credit score, limit access to further credit, and result in collection actions. Many consumers are unsure of how to address these debts alongside other financial obligations.

Debt Relief Programs: An Overview

Debt relief programs are designed to help individuals reduce their overall debt burden, making it easier to manage payments. These programs can include debt consolidation, settlement, and counseling.

Types of Debt Relief Programs

- Debt Consolidation: Combines multiple debts into a single loan with a lower interest rate.

- Debt Settlement: Negotiates with creditors to settle debts for less than the full amount owed.

- Credit Counseling: Provides guidance and budgeting strategies to manage debt effectively.

Including Medical Debt in Debt Relief Programs

The short answer is yes, medical debt can often be included in debt relief programs. The process may vary depending on the type of program and individual circumstances.

How Medical Debt Fits In

- Debt Consolidation Loans: Medical debts can be consolidated alongside other unsecured debts, allowing for a single, manageable payment each month.

- Debt Settlement: Some debt settlement companies can negotiate directly with healthcare providers and collection agencies to reduce the total amount owed.

- Credit Counseling Services: Counselors can help develop a repayment plan that includes medical debts, often providing tools to negotiate better terms with creditors.

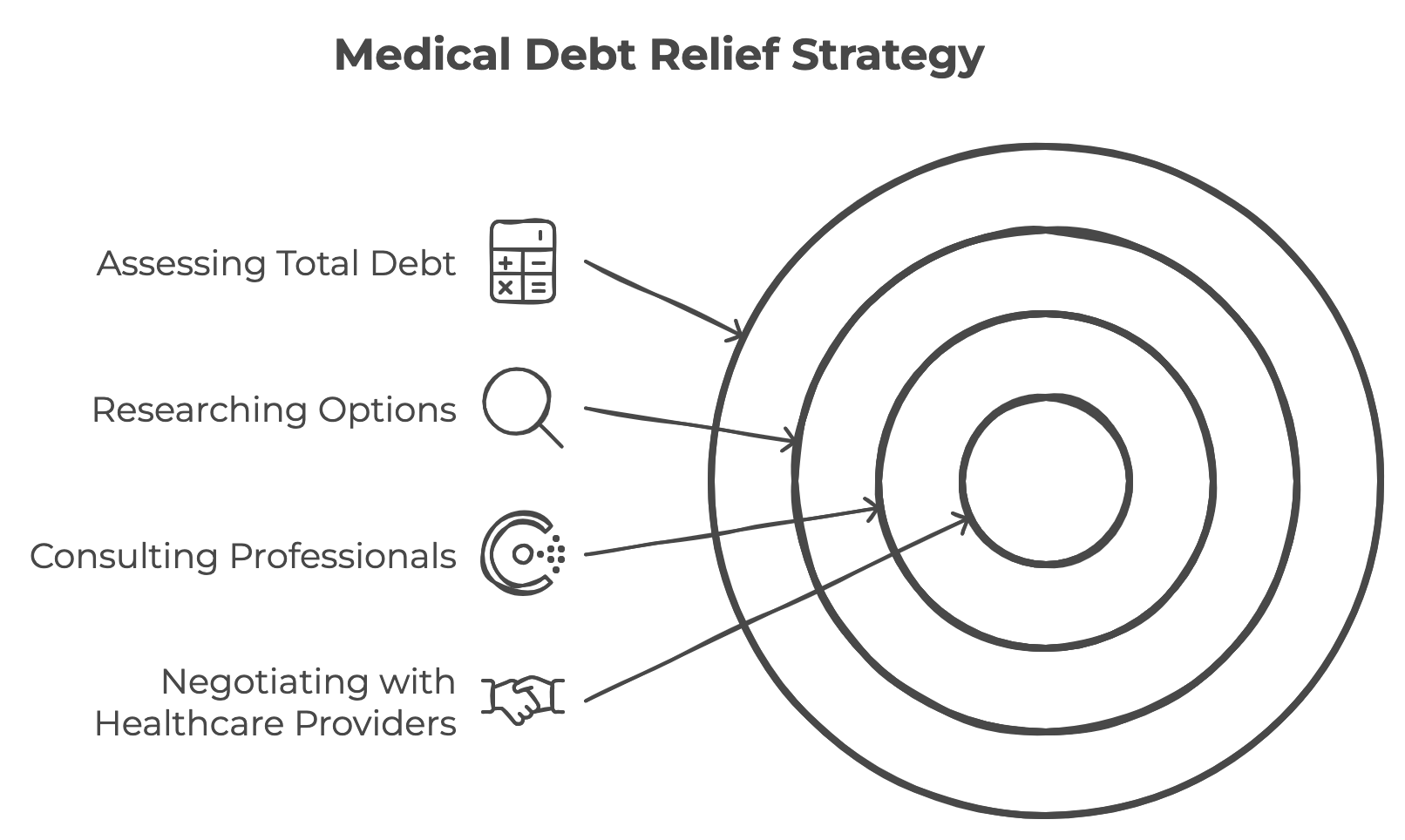

How to Proceed with Medical Debt Relief

To effectively include medical debt in a debt relief strategy, consider the following steps:

- Assess Your Total Debt: Calculate the total amount of your medical debt alongside other obligations.

- Research Your Options: Explore various debt relief programs and understand how they handle medical debt.

- Consult a Professional: Seek advice from financial advisors or credit counseling agencies to identify the best strategy for your situation.

- Negotiate with Healthcare Providers: Some hospitals and medical providers may offer reduced payments or interest-free payment plans.

Conclusion

Handling medical debt can seem daunting, but including it in a debt relief program can provide much-needed financial relief. By understanding your options and seeking professional guidance, you can take control of your financial future and reduce the stress associated with overwhelming medical expenses.

Take Control of Your Medical Debt Today

Medical bills shouldn’t define your financial future. At DebtBusters, we specialize in helping individuals like you reduce their medical debt and regain financial stability. Whether through consolidation, settlement, or counseling, we’ll work with you to find a solution tailored to your needs.

Call us today at 866-223-4395 to schedule your free consultation. Let us guide you toward a debt-free future with compassionate, professional support.

Your path to financial relief starts now—take the first step with DebtBusters.

Related Content: