Struggling with debt while having no money and bad credit can feel like being stuck in quicksand. Many believe that financial freedom is only attainable for those with high incomes or excellent credit scores, but this isn’t true. There are ways to navigate out of debt even under these difficult circumstances. This guide is designed for individuals overwhelmed by their financial burdens, offering clear strategies to help regain control.

Understanding Your Debt Situation

The first step in tackling your debt is to fully understand your financial situation. Start by listing all your debts, including the creditors and the amounts owed. Knowing the total amount you owe can be daunting, but it’s essential for creating a repayment strategy.

- Create a Comprehensive List: Include all credit cards, personal loans, student loans, and any other debts.

- Note Interest Rates and Monthly Payments: Determine which debts have the highest interest rates. These typically cost you more in the long run and might be prioritized in your repayment plan.

Developing a Budget

With limited resources, budgeting becomes a crucial tool. A budget helps ensure that every dollar you have is working toward improving your financial health.

- Assess Your Income and Expenses: Calculate all sources of income and list all monthly expenses. This will highlight areas where you can cut back.

- Identify Nonessential Expenditures: Look for subscription services, dining out expenses, or luxury items that can be eliminated or reduced.

- Set a Realistic Goal: Based on your budget, decide on a manageable amount to allocate toward debt repayment each month, even if it’s small.

Exploring Debt Relief Options

People often mistakenly believe debt relief options are only for specific types of debt. However, several avenues can offer assistance.

Debt Settlement

Debt settlement involves negotiating with creditors to pay less than what you owe. While this might seem appealing, it typically requires a lump-sum payment.

- Pros and Cons: This could damage your credit further but might allow you to clear a substantial portion of your debt.

- Contact Creditors Directly: Start negotiations yourself or consider hiring a reputable debt settlement company.

Credit Counseling

A credit counselor can help you develop a personalized plan to handle your debts. They provide advice on managing money, budgeting, and offer free workshops.

- Find Non-Profit Agencies: Seek help from non-profit credit counseling agencies that can offer free or low-cost services.

- Debt Management Plans (DMPs): These plans allow you to consolidate multiple debts into a single monthly payment. Counselors can often negotiate lower interest rates or fees on behalf of clients.

Bankruptcy

Though considered a last resort, bankruptcy can give you relief from overwhelming debt.

- Chapter 7 and Chapter 13: Familiarize yourself with different types of bankruptcy and their implications.

- Consult with a Legal Expert: Before making decisions, speak with a bankruptcy attorney to understand potential outcomes and consequences.

Building an Emergency Fund

Even while managing debt, creating an emergency fund is crucial to avoid future debt pitfalls. Aim to save even small amounts to cushion against unexpected expenses.

- Start Small: Begin with a goal of $500, which can cover most minor emergencies.

- Automate Savings: If possible, set up automatic transfers to a savings account dedicated to emergencies.

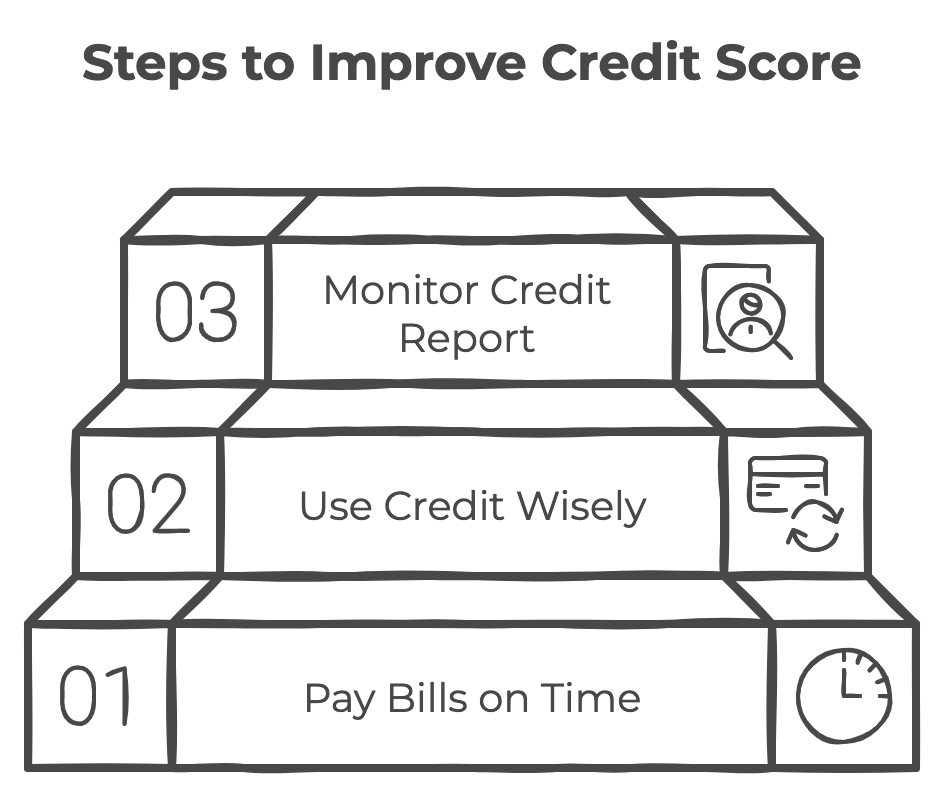

Improving Your Credit Score Over Time

Improving your credit score opens up more financial possibilities and can help you get better terms on loans or repayment plans.

- Pay Bills on Time: On-time payments are essential for improving credit scores.

- Use Credit Wisely: If possible, use a credit card for small purchases and pay off the balance each month to build credit without accruing new debt.

- Monitor Your Credit Report: Regularly check your credit reports for accuracy at the three major credit bureaus: Equifax, Experian, and TransUnion.

Conclusion

Getting out of debt with no money and bad credit requires patience, dedication, and a strategic approach. By understanding your debt, budgeting effectively, and exploring available relief options, you can gradually improve your financial standing. Remember, each small step forward is progress.

Start Your Journey to Financial Freedom Today

If debt feels like an insurmountable challenge, DebtBusters is here to provide real solutions tailored to your unique situation. With no upfront fees and a proven track record of helping individuals overcome even the most difficult financial hurdles, we’re ready to help you take control.

Don’t let bad credit or limited income hold you back. Call us today at 866-223-4395 or visit DebtBusters.com for your free consultation. Take the first step toward a brighter financial future—we’re with you every step of the way.

Related Content: