Imagine this: You’re an Arizona resident juggling bills, and suddenly, the dreaded letter arrives. A debt collection agency in Arizona is demanding payment for an old debt. These agencies purchase debts from original creditors and use various tactics to collect the money owed.

Debt collectors often report these debts to a credit reporting company, which can further impact your credit score. Panic sets in. You’re tempted to pay it off just to make it disappear. But hold on – that might be the worst decision you could make. Instead, consider debt settlement as an alternative to paying a collection agency.

The Myth: Paying a Collection Agency Solves the Problem

Many people mistakenly believe that paying a collection agency is the responsible thing to do. They think it will clear their name, boost their credit score, and bring peace of mind, especially when the debt is reported to a credit reporting company. However, this is a widespread myth that can lead to financial disaster.

The Truth: Paying Collection Agencies Can Make Things Worse

Paying a collection agency in Arizona can trigger a cascade of negative consequences:

- Credit Score Damage: Unlike paying the original creditor, paying a collection agency doesn’t automatically improve your credit. In fact, it can prolong the negative impact on your credit report. Debt collectors report these payments to a credit reporting company, which can keep the negative mark on your credit report for years.

- Debt Validation Risks: Paying without verifying the debt’s validity can be costly. The debt could be inaccurate, expired, or belong to someone else.

- Zombie Debt Revival: Paying off old debts can resurrect them from the dead, restarting the statute of limitations and giving collectors more time to pursue legal action.

- Lawsuit Threats: Paying a collection agency doesn’t guarantee they won’t sue you later. You might end up paying and still facing legal battles.

- Collection Fees: Paying a collection agency can result in additional collection fees, increasing the total amount owed. A debt management plan can be a better alternative to avoid these fees and manage your debt more effectively.

The DebtBusters Solution: Expert Guidance Through the Debt Maze

DebtBusters Law Firm is your trusted ally in navigating the complex world of debt collection in Arizona. We’ll help you understand your rights, explore your options, and fight for your financial future.

Introduction to Debt Collection

Debt collection is the process by which creditors attempt to recover unpaid debts from individuals or businesses. This can involve a range of activities, from phone calls and letters to legal action. For Arizona residents, understanding this process is crucial, as it can impact their financial stability and credit health.

In Arizona, like elsewhere, unpaid debts are initially handled by the original creditor. If the creditor is unable to collect the debt, they may sell it to a collection agency. These agencies purchase debts for a fraction of their value and then attempt to collect the full amount from the debtor. This is where the debt collection process can become particularly stressful and confusing for individuals.

Arizona has specific laws and protections in place for residents dealing with debt collectors. Knowing these laws can help you navigate interactions with collection agencies, protect your rights, and avoid potential pitfalls. This guide aims to provide you with the essential knowledge and practical steps to manage debt collection effectively.

Understanding Debt Collection in Arizona

Debt collection is a multi-faceted process with specific rules and regulations in Arizona. Let’s break it down.

Detailed Explanation of Arizona-Specific Laws

Arizona has enacted laws that provide additional protections for consumers beyond the federal Fair Debt Collection Practices Act (FDCPA). One key statute is Arizona Revised Statutes §12-1588, which imposes a statute of limitations on certain types of debt.

Arizona Revised Statutes §12-1588

This statute sets a three-year limit for filing lawsuits to collect on debts for services rendered. This means that if a creditor or collection agency has not filed a lawsuit within three years of the debt becoming delinquent, they are barred from doing so. This is shorter than the federal limit, which can be beneficial for Arizona residents.

Other Relevant Laws

- Arizona Fair Debt Collection Practices Act: This state law mirrors many protections of the FDCPA but includes additional provisions to safeguard consumers.

- Licensing Requirements: Arizona requires that all debt collectors operating within the state be licensed and bonded. This ensures that only legitimate and financially stable agencies can attempt to collect debts from residents.

These laws are designed to protect consumers from abusive, deceptive, and unfair debt collection practices. They provide a framework for fair debt collection and offer legal recourse if these standards are violated.

Consumer Rights and Protections

Consumers in Arizona are protected by both federal and state laws. Understanding these rights is essential to protect yourself from aggressive or unlawful debt collection practices.

Federal Protections: FDCPA

The FDCPA prohibits debt collectors from using abusive, unfair, or deceptive practices. Key protections include:

- No Harassment: Collectors cannot harass or abuse you.

- Validation of Debt: You have the right to request validation of the debt within 30 days of the first contact. A debt validation letter is crucial as it allows you to verify the legitimacy of the debt and ensures that the collector has the right to collect it.

- Limitations on Contact: Collectors cannot contact you at inconvenient times or places, such as before 8 a.m. or after 9 p.m., or at work if you inform them it is not allowed. The FDCPA also regulates how and when debt collector contacts can occur, ensuring they do not harass or abuse consumers.

Arizona State Protections

In addition to the FDCPA, Arizona law offers further protections:

- Shorter Statute of Limitations: As mentioned, certain debts have a three-year statute of limitations.

- Licensing and Bonding: Ensures that only reputable agencies can operate in the state.

Filing Complaints

If a debt collector violates your rights, you can file a complaint with the following authorities:

- Arizona Attorney General’s Office: [Contact Information]

- Consumer Financial Protection Bureau (CFPB): [Contact Information]

- Federal Trade Commission (FTC): [Contact Information]

Providing detailed information about your experience can help these agencies take appropriate action against the collector.

Practical Steps for Arizona Residents

Dealing with debt collectors can be overwhelming, but following these steps can help you manage the situation effectively.

Step-by-Step Instructions

- Verify the Debt: Always request validation of the debt. Ensure that the debt is yours, the amount is correct, and the collector has the right to collect it.

- Keep Records: Document all interactions with the debt collector. Keep copies of letters and make notes of phone calls, including dates, times, and what was discussed.

- Know Your Rights: Familiarize yourself with both federal and Arizona-specific debt collection laws. Understand what collectors can and cannot do.

- Communicate in Writing: Whenever possible, communicate with debt collectors in writing. This provides a paper trail and can help protect your rights.

- Dispute Incorrect Debts: If you believe the debt is not yours or is incorrect, dispute it in writing with the collector and the credit bureaus.

- Seek Legal Advice: If you’re unsure about your rights or how to proceed, consider consulting with a consumer rights attorney.

Flowchart for Quick Reference

To make these steps easier to follow, here is a simplified flowchart:

Receive Contact from Collector

↓

Request Debt Validation

↓

Verify Debt

↓

Keep Records and Communicate in Writing

↓

Dispute Incorrect Debts

↓

Seek Legal Advice if Needed

By following these steps, you can effectively manage your interactions with debt collectors and protect your financial well-being. Remember, knowledge is power when it comes to debt collection.

What’s the Difference Between an Original Creditor and a Debt Collector?

The original creditor is the company you initially borrowed money from or made a purchase with (e.g., credit card company, medical provider, auto lender). If you fall behind on payments, the original creditor may try to collect the debt themselves. However, they often sell the debt to a third-party collection agency for pennies on the dollar.

How Debt Goes from the Original Creditor to a Debt Collector

When you become delinquent on a debt, the original creditor may make a few attempts to collect it themselves. If they’re unsuccessful, they often sell the debt to a collection agency. This usually happens after 4-6 months of non-payment. Sometimes, original creditors use their own in-house collection departments, but the process is similar.

How Do You Find Out if Your Debt Has Been Sent to Collections?

The original creditor typically informs you when your account is transferred to collections. However, you can also check your credit report. Credit reporting companies will list any debts that have been sent to collections, providing you with the necessary information. If you see a new entry from a collection agency, it means your debt has been sold.

The Risks of Dealing with Debt Collectors

Dealing with debt collectors can be stressful and confusing. Here’s what you need to watch out for:

- They Must Give You Proper Notice: Legitimate debt collectors are required to provide you with a written notice, known as a “validation letter,” within five days of their initial contact. This letter must include the amount owed, the name of the original creditor, and your rights to dispute the debt.

- Ignoring Them Can Lead to Trouble: While it’s tempting to avoid their calls and letters, ignoring debt collectors can backfire. It can lead to lawsuits, wage garnishment, and further damage to your credit.

- Increased Interest and Penalties: Collection agencies can often add interest and fees to the original debt, making it even harder to pay off.

- Collection Fees: Debt collectors may also charge collection fees, which can significantly increase the total amount you owe.

- Negative Impact on Your Credit: A debt in collections will stay on your credit report for seven years, even if you eventually pay it off.

- Verify the Legitimacy of the Debt Collection Company: Dealing with a debt collection company can sometimes involve scams or illegal activities. It is crucial to verify the legitimacy of the company to avoid potential consequences.

Arizona-Specific Debt Collection Laws

Arizona law provides additional protections to consumers beyond the federal Fair Debt Collection Practices Act (FDCPA). For instance, Arizona Revised Statutes §12-1588 imposes a shorter statute of limitations of three years for certain types of debt, such as debts for services rendered. Understanding these specific laws is crucial for Arizona residents facing debt collection.

Collection Agency Tactics: Real-World Examples

Arizona collection agencies often resort to aggressive tactics to pressure debtors into paying. These tactics may include:

- Threatening Legal Action: Collectors might falsely claim they will sue you or garnish your wages if you don’t pay immediately.

- Misrepresenting the Amount Owed: They might inflate the debt amount or add unauthorized fees.

- Contacting Your Employer or Family: Collectors may try to embarrass you by contacting your employer or family members about your debt.

- Ignoring Your Requests to Stop Contact: They might continue to call or send letters even after you’ve asked them to stop.

If you experience any of these tactics, document the interactions and report them to the Arizona Attorney General’s office or the Consumer Financial Protection Bureau (CFPB).

Debt Types and Collection Differences

The collection process can vary depending on the type of debt you owe. Here are some common debt types and how collection might differ:

- Credit Card Debt: Credit card companies typically sell delinquent accounts to collection agencies after 180 days of non-payment.

- Medical Debt: Medical bills are often sent to collections more quickly, sometimes after just 90 days.

- Student Loan Debt: Federal student loans have their own unique collection process, which can include wage garnishment and tax refund offsets.

- Auto Loan Debt: If you default on your car loan, the lender can repossess your vehicle.

Understanding the nuances of different debt types can help you tailor your response to collection efforts.

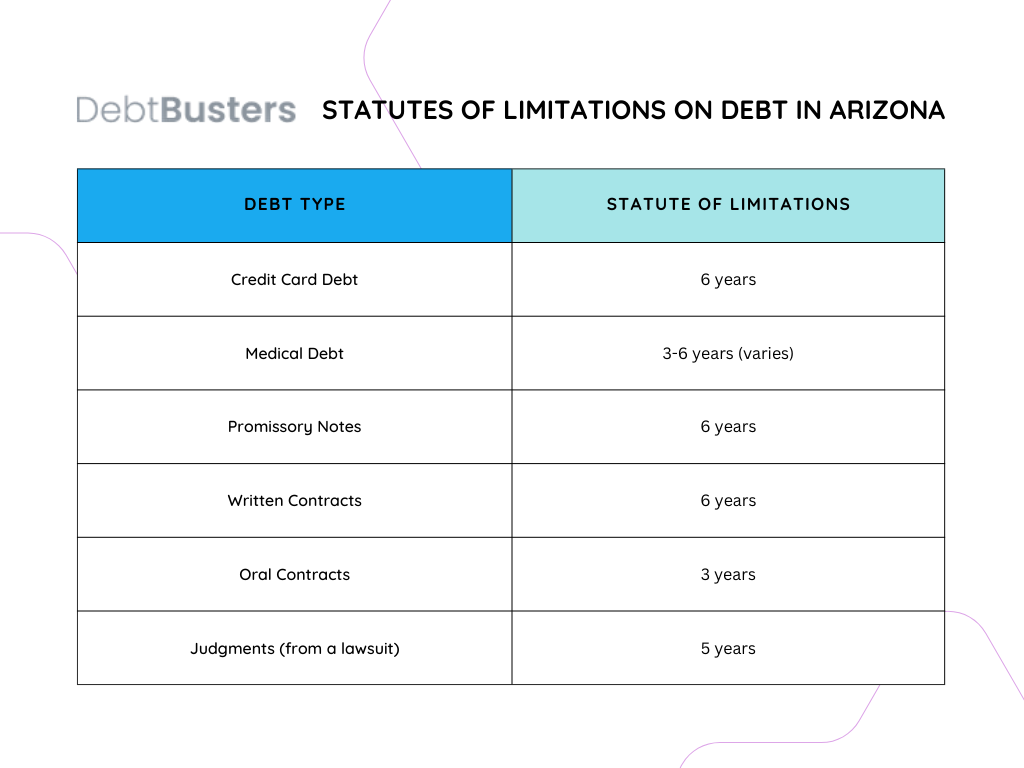

Detailed Table of Statutes of Limitations in Arizona

It’s crucial to note that the statute of limitations starts running from the date of your last payment or the date the debt became delinquent.

The Dangers of Paying a Collection Agency

Now that you understand the debt collection landscape in Arizona let’s delve into the specific dangers of paying a collection agency.

Consequences of Paying a Debt Collection Agency

Paying a collection agency might seem like the easiest way to resolve a debt, but it often leads to unintended consequences.

- Minimal Impact on Your Credit Report: Contrary to popular belief, paying a collection agency won’t magically erase the negative mark on your credit report. The collection account will remain on your report for seven years from the date of delinquency, regardless of whether it’s paid or not. It might be marked as “paid,” but the damage to your credit score has already been done.

Can You Negotiate with a Debt Collector?

Yes, you absolutely can. Many collection agencies will negotiate a settlement for less than the full amount owed. This is especially true for older debts or accounts where the chances of full recovery are slim. Negotiating a settlement can be a viable option, but it’s important to understand the potential downsides, such as the tax implications of forgiven debt. Additionally, ensure that any settlements are reported accurately to a credit reporting company.

Why You Should Never Pay a Charged-Off Debt

A charged-off debt is one that the original creditor has given up on collecting. When a debt is charged off, it’s usually sold to a collection agency. Paying a charged-off debt might seem like a good idea, but it can actually hurt you more than it helps.

- Reviving the Statute of Limitations: In Arizona, the statute of limitations on most debts is six years. This means that if the creditor or collector hasn’t sued you within six years of your last payment, they can no longer take legal action to collect the debt. However, making a payment on a charged-off debt restarts the clock on the statute of limitations, giving the collector another six years to sue you.

- No Guarantee of Credit Improvement: Paying a charged-off debt might not improve your credit score as much as you hope. While it’s true that paying off any debt can be beneficial, the negative impact of a charged-off account can linger for years.

The “Pay for Delete” Myth

Some debtors have heard of a strategy called “pay for delete,” where you negotiate with the collection agency to remove the negative item from your credit report in exchange for payment. While this can work in some cases, there’s no guarantee. The collection agency isn’t obligated to agree to this arrangement, and even if they do, there’s no way to enforce it.

Credit Score Damage:

One of the most significant risks of paying a collection agency is the potential damage to your credit score.

- Payment History: Your payment history is the most critical factor in your credit score, accounting for roughly 35% of the total score. When you miss payments on a debt, it gets reported to the credit bureaus, and your score takes a hit. Paying a collection agency might stop further negative reporting, but it doesn’t erase the previous missed payments.

- Length of Credit History: The length of your credit history is another important factor in your credit score. It accounts for about 15% of the total score. When you pay off a collection account, it could potentially shorten your overall credit history and negatively impact this factor.

- Credit Mix: Your credit mix refers to the different types of credit you have, such as credit cards, loans, and mortgages. It makes up about 10% of your credit score. Paying off a collection account could change your credit mix if it’s the only installment loan on your report.

Debt Validation: Your Secret Weapon

Before you even consider paying a collection agency, it’s crucial to verify that the debt is legitimate and accurate. This is where debt validation comes in.

- What is Debt Validation? It’s your right under the Fair Debt Collection Practices Act (FDCPA) to request validation of the debt within 30 days of receiving the validation letter. This means the collector must prove that the debt is yours and the correct amount.

- How to Request Debt Validation: You can send a debt validation letter to the collection agency, requesting documentation such as the original contract, billing statements, and payment history. It’s essential to do this in writing and send it via certified mail with a return receipt requested.

Potential Outcomes of Debt Validation:

After you request debt validation, several things can happen:

- Verification: The collection agency provides you with the requested documentation, proving the debt is valid. In this case, you may decide to negotiate a settlement or explore other options.

- Inaccurate or Incomplete Information: The collector might not be able to provide sufficient documentation or may have incorrect information. If this happens, you can dispute the debt with the credit bureaus and potentially have it removed from your credit report.

- No Response: If the collection agency doesn’t respond within 30 days, it is legally obligated to cease collection activities until it provides validation.

Zombie Debt and Re-Aging

Zombie debt refers to old debts that have been written off or passed the statute of limitations. These debts can come back to haunt you if you make a payment on them, as it can restart the statute of limitations, giving collectors more time to pursue legal action. This process is called “re-aging.”

Re-aging can happen even if you only make a partial payment or acknowledge the debt verbally. To avoid reviving zombie debt, it’s crucial to consult with a bankruptcy attorney before making any payments on old debts. If the debt is revived, collectors might target your bank account.

The Lawsuit Risk

Paying a collection agency doesn’t necessarily shield you from a lawsuit. In fact, it can sometimes make you a more attractive target, as it confirms your ability to pay. Collectors might sue you to collect the remaining balance, especially if the debt is large or if they believe you have assets they can seize.

If you are sued for debt, responding promptly and seeking legal counsel is crucial. Ignoring a lawsuit can lead to a default judgment, which gives the collector the right to garnish your wages, levy your bank account, or place liens on your property.

Detailed Explanation of Credit Reporting and Impacts

A collection account can significantly impact your credit score, even after you pay it off. Here’s how it’s typically reported on your credit report:

- Status: The account will be listed as “collection” or “charged off.” It will also show the original creditor’s name, the date of delinquency, the balance owed, and whether the account is paid or unpaid.

- Payment History: The account will show a history of late payments leading up to the collection or charge-off. Even if you pay the collection agency, these negative marks will remain on your report.

- Impact on Score: A collection account can lower your credit score by 100 points or more, depending on your overall credit history. A paid collection account is slightly less damaging than an unpaid one, but it still significantly impacts your score.

Debt collectors report debts to credit reporting companies, which then reflect these accounts on your credit report. Credit bureaus are responsible for reporting these debts.

Tax Implications of Debt Forgiveness

If you settle a debt with a collection agency for less than the full amount owed, the forgiven amount may be considered taxable income by the IRS. This is known as “cancellation of debt” (COD) income. You might receive a 1099-C form from the creditor or collector, and you’ll need to report this income on your tax return.

However, there are exceptions to the COD income rule. For example, if the debt was discharged in bankruptcy or if you were insolvent at the time of the settlement, you might not owe taxes on the forgiven amount. It’s crucial to consult with a tax professional or attorney to understand the tax implications of debt settlement.

Alternatives to “Pay for Delete”

While “pay for delete” might seem like a tempting strategy, it’s not always successful. Here are some alternative approaches to consider:

- Goodwill Adjustment: If you have a good payment history with the original creditor, you can request a goodwill adjustment. This involves asking the creditor to remove the collection account from your credit report as a gesture of goodwill.

- Lump-Sum Payment for Reduced Balance: Offer to pay a lump sum in exchange for a significant reduction in the balance owed. This can be an effective way to settle the debt for less and potentially improve your credit score faster than making monthly payments.

Case Studies: The Real Cost of Paying Collections

Let’s look at two hypothetical examples to illustrate the potential risks of paying a collection agency:

Example 1: John’s Credit Score Nightmare

John had a $5,000 credit card debt that went to collections. He decided to pay it off, hoping to improve his credit score. However, the collection account remained on his credit report for seven years, marked as “paid collection.” This continued to drag down his score, making it difficult for him to qualify for loans or get favorable interest rates.

Example 2: Maria’s Revived Debt

Maria had a $10,000 medical debt that was over six years old. The statute of limitations had expired, and she hadn’t heard from the collector in years. One day, she received a letter offering a settlement for $5,000. She decided to pay it, hoping to put the debt behind her. However, this revived the debt, restarting the statute of limitations. The collector then sued her for the remaining balance, and she ended up paying more than she originally owed.

Tax Implications in Detail

Forgiven Debt and Taxable Income

When you settle a debt for less than what you owe, the forgiven amount is often considered taxable income by the IRS. This means you could receive a 1099-C form from the creditor or collection agency, detailing the amount of debt forgiven. It’s essential to understand that this forgiven debt can impact your tax return and potentially increase your tax liability.

For instance, if you had a $10,000 debt and settled it for $6,000, the remaining $4,000 could be considered taxable income. This $4,000 will be added to your taxable income for the year, possibly pushing you into a higher tax bracket. Additionally, the forgiven debt might still appear on your credit report.

Insolvency and Tax Exemptions

There are scenarios where the forgiven debt may not be taxable. One key exemption is insolvency. If you can prove you were insolvent at the time the debt was forgiven, you may not have to pay taxes on the forgiven amount. Insolvency means your total liabilities exceed your total assets.

To determine insolvency, calculate your total liabilities (debts and obligations) and your total assets (cash, property, investments). If your liabilities are greater than your assets, you are considered insolvent. You can then exclude the forgiven debt from your taxable income to the extent of your insolvency.

Process of Claiming Insolvency

Claiming insolvency involves specific steps:

- Calculate Total Assets and Liabilities: List all your assets and liabilities.

- Complete IRS Form 982: This form is used to reduce the tax attributes due to discharge of indebtedness.

- Attach Supporting Documentation: Provide proof of insolvency with your tax return. This can include bank statements, credit card statements, and other financial documents.

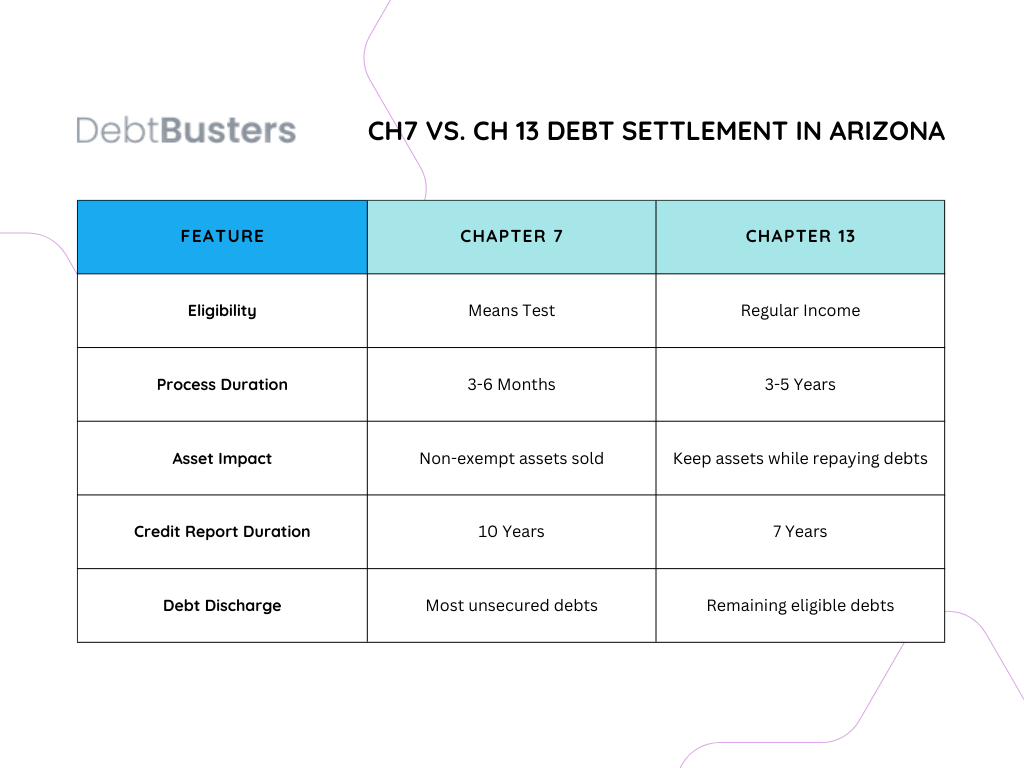

Bankruptcy Process and Implications

Chapter 7 Bankruptcy

Eligibility:

- You must pass the means test, which compares your income to the median income in Arizona.

- If your income is below the median, you qualify automatically. If above, additional calculations determine eligibility.

Process:

- Filing Petition: Submit a petition with detailed information about your finances.

- Automatic Stay: Stops most collection actions against you immediately.

- Trustee Appointment: A trustee is assigned to oversee your case and sell non-exempt assets.

- Debt Discharge: Most unsecured debts are discharged, meaning you are no longer legally obligated to pay them.

Impact:

- Credit Score: Significantly impacts your credit score, staying on your report for 10 years.

- Assets: Non-exempt assets are sold to pay creditors.

Chapter 13 Bankruptcy

Eligibility:

- Suitable for individuals with a regular income.

- You must have unsecured debts less than $419,275 and secured debts less than $1,257,850.

Process:

- Filing Petition: Submit a petition along with a repayment plan proposal.

- Automatic Stay: Stops most collection actions immediately.

- Repayment Plan: Make monthly payments to a trustee over three to five years.

- Debt Discharge: Remaining eligible debts are discharged after completing the repayment plan.

Impact:

- Credit Score: Affects your credit score, but remains on your report for only 7 years.

- Assets: Allows you to keep your property while making payments.

Comparison Table

Debt Settlement Negotiation Tips

Strategies for Negotiating with Debt Collectors

- Research and Prepare: Know your debt details and your financial limits.

- Start Low: Offer a settlement amount lower than what you can actually pay.

- Document Everything: Keep records of all communications and agreements.

- Negotiate Hardship: Explain your financial situation to persuade the collector for a lower settlement.

- Request a “Paid in Full” Letter: Ensure you get this after settling the debt to avoid future collection efforts.

Pitfalls to Avoid

- Paying Without Documentation: Always get the agreement in writing before making any payment.

- Ignoring Tax Implications: Remember that forgiven debt may be taxable.

- Restarting the Statute of Limitations: Making a payment without a settlement agreement can reset the statute of limitations, allowing the collector more time to sue you.

Third-Party Negotiation vs. Self-Negotiation

Third-Party Services:

- Pros: Professionals handle negotiations and potentially better outcomes.

- Cons: Service fees, less control over the process.

Self-Negotiation:

- Pros: No service fees and direct control over negotiations.

- Cons: Time-consuming, requires knowledge and confidence.

Credit Repair and Improvement Strategies

Steps to Repair and Improve Your Credit

- Review Credit Reports: Obtain reports from all three credit bureaus and check for errors.

- Dispute Inaccuracies: File disputes with the credit bureaus to correct mistakes.

- Pay Down Balances: Reduce credit card balances to lower your credit utilization ratio.

- Make On-Time Payments: Establish a record of on-time payments to improve your payment history.

- Avoid New Credit: Minimize applying for new credit to reduce hard inquiries.

Timelines for Improvement

- Immediate: Correcting errors can improve your score quickly.

- 6-12 Months: Consistently paying down balances and making on-time payments will start to show significant improvement.

- Long-Term: Building a strong credit history over time by maintaining low balances and good payment habits.

Resources and Tools

- Credit Monitoring Services: Use services like Credit Karma or Experian to monitor your credit.

- Financial Counseling: Seek advice from non-profit credit counseling agencies.

- Credit Repair Services: Consider professional help for complex issues, but research thoroughly to avoid scams.

By following these steps and utilizing available resources, you can effectively repair and improve your credit score after dealing with collections.

What to Do If You’re Contacted by a Collection Agency in Arizona

Being contacted by a collection agency can be overwhelming, but it’s important to remain calm and know your rights.

Do You Have to Pay Debt Collectors?

You are legally obligated to pay a debt collector if the debt is valid, belongs to you, and is within the statute of limitations. However, you can request debt validation and dispute any inaccuracies. You also have the right to negotiate a settlement or explore other options.

What Happens If You Don’t Pay a Debt Collector?

Ignoring a debt collector won’t make the debt disappear. In fact, it can make things worse. Here’s what might happen if you don’t pay:

- Continued Collection Efforts: The collection agency will likely intensify its debt collection efforts. This could involve more frequent phone calls, letters, and even visits to your home or workplace.

- Negative Impact on Your Credit: Your credit score will continue to suffer if unpaid debt remains. Unpaid debt can remain on your credit report for up to seven years, significantly impacting your credit score and limiting your financial options.

- Lawsuit and Judgment: The collector might sue you for the debt. If they win, they could obtain a judgment allowing them to garnish your wages, levy your bank account, or place liens on your property. Additionally, you risk facing a debt collection lawsuit if you don’t pay.

What Happens If You Never Pay Collections?

If you never pay a debt in collections, the negative consequences can be significant. Your credit score will suffer, you’ll face ongoing harassment from collectors, and you could eventually be sued. However, there are alternatives to simply ignoring the debt. You can negotiate a settlement, create a debt management plan, or consider bankruptcy as a last resort.

Do Not Panic

It’s natural to feel overwhelmed when you receive a collection notice, but it’s important to remain calm and avoid making rash decisions. Panicking can lead to costly mistakes, such as paying a debt you don’t owe or agreeing to a settlement you can’t afford.

Communication Strategies: Effective Responses to Collectors

Knowing how to communicate with collectors can make a significant difference in how your case is handled. Here are some effective strategies:

- Be Polite But Firm: Maintain a calm and respectful tone, even if the collector is aggressive or rude. Don’t let them intimidate you.

- Ask for Identification: Always ask for the collector’s name, company name, address, and phone number. Verify their information before proceeding with any discussion.

- Request Debt Validation: If you haven’t received a validation notice, request one in writing. Don’t make any payments or promises to pay until you’ve validated the debt.

- Know When to Stop Talking: If the collector is being abusive or refusing to answer your questions, end the conversation politely and hang up. You have the right to cease communication.

Debt Validation Deep Dive: Sample Letters and Responses

A well-crafted debt validation letter can be a powerful tool in your arsenal. Here’s a sample letter you can adapt:

[Your Name]

[Your Address]

[Date]

[Collection Agency Name]

[Collection Agency Address]

Re: Debt Validation for Account Number [Account Number]

To Whom It May Concern:

This letter is to formally request validation of the debt you claim I owe. I am disputing this debt and requesting verification pursuant to the Fair Debt Collection Practices Act (FDCPA).

Please provide me with the following information within 30 days of receiving this letter:

* Proof of the debt, such as the original contract or agreement

* A complete history of the account, including all transactions and payments

* Your company's name, address, and contact information

* The name and address of the original creditor

If you are unable to provide this information, I request that you cease all collection activities immediately and remove this debt from my credit report.

Sincerely,

[Your Signature]

[Your Printed Name]

If the collection agency fails to provide adequate validation within 30 days, you can send a follow-up letter demanding that they stop contacting you and remove the debt from your credit report.

Settlement Negotiation Tactics: Tips for Getting a Better Deal

Negotiating a debt settlement can be intimidating, but with the right approach, you can often secure a favorable outcome. Here are some tips:

- Do Your Research: Know how much you can realistically afford to pay and gather information about the debt, such as the age and current balance.

- Start Low: Offer a settlement amount lower than what you’re willing to pay. Collectors often expect negotiation, and starting low gives you room to maneuver.

- Be Persistent: Don’t give up if the collector rejects your initial offer. Counter with a higher amount, but stay within your budget.

- Get It in Writing: Once you reach an agreement, get it in writing before making any payments. The agreement should clearly state the settlement amount, payment terms, and how the debt will be reported to the credit bureaus.

When to Consult with a Bankruptcy Attorney

While you can often handle debt collection issues yourself, there are situations where seeking legal counsel is advisable. Consider consulting with a bankruptcy attorney if:

- You’re facing a lawsuit from a collector.

- The debt is substantial and you can’t afford to pay it.

- You’re being harassed or threatened by collectors.

- You’re considering bankruptcy as a potential solution.

An attorney can help you understand your rights, protect your assets, and negotiate with creditors on your behalf.

Know Your Rights: The Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive, deceptive, and unfair debt collection practices. In Arizona, the FDCPA is complemented by state laws that offer additional protections. Understanding your rights under these laws is crucial for dealing with debt collectors.

Under the FDCPA, debt collectors:

- Cannot contact you at inconvenient times or places, such as before 8 a.m. or after 9 p.m.

- Cannot harass, threaten, or use abusive language.

- Must stop contacting you if you request it in writing.

- Cannot make false or misleading statements about the debt.

- Must provide you with a validation notice within five days of their initial contact.

If a collector violates the FDCPA, you can report them to the Consumer Financial Protection Bureau (CFPB) or file a lawsuit against them.

Document Everything

Keep meticulous records of all communication with debt collectors. This includes:

- Dates and times of phone calls

- Copies of letters and emails

- Notes on conversations

- Any payments you make

This documentation will be valuable if you need to dispute the debt, file a complaint, or take legal action.

Dispute the Debt (If Applicable)

If you believe the debt is inaccurate or doesn’t belong to you, you can dispute it. You can do this by sending a dispute letter to the collection agency within 30 days of receiving the validation notice. In your letter, clearly state the reasons for your dispute and request proof of the debt.

Negotiate a Settlement (If Applicable)

If you’re unable to dispute the debt but can’t afford to pay the full amount, you can try negotiating a settlement with the collector. This involves offering to pay a reduced amount in exchange for the collector agreeing to forgive the remaining balance. It’s important to get a written settlement agreement before making any payments.

Understanding Your Rights: Arizona Fair Debt Collection Practices

In addition to the federal FDCPA, Arizona has its own Fair Debt Collection Practices Act that provides additional consumer protections. This act prohibits debt collectors from using abusive, deceptive, or unfair practices to collect debts.

Arizona’s law also requires debt collectors to be licensed and bonded. This means they must have a license to operate in the state and a bond to protect consumers from financial harm.

Alternatives to Paying a Debt Collection Agency

If you’re struggling with debt, paying a collection agency isn’t your only option. Here are some alternatives to consider:

- Debt Management Plan (DMP): A DMP is a structured repayment plan offered by credit counseling agencies. It consolidates your debts into one monthly payment and often includes lower interest rates.

- Debt Settlement: This involves negotiating with your creditors to settle your debts for less than the full amount owed. Debt settlement can be risky, but it can also be a viable option for those who are unable to repay their debts in full.

- Bankruptcy: Filing for bankruptcy is a legal process that can eliminate or restructure your debts. It’s a major decision with long-term consequences, but it can also provide a fresh start for those who are overwhelmed by debt.

Additionally, medical debt is a specific type of debt that might be handled differently, often with more flexible repayment options or assistance programs.

DebtBusters Law Firm – Your Arizona Bankruptcy Experts

If you’re overwhelmed by debt and facing relentless collection calls, DebtBusters Law Firm is here to help. We are a team of experienced bankruptcy attorneys specializing in Arizona debt collection laws. We understand the tactics collectors use and know how to protect your rights.

Our Expertise

At DebtBusters, we have a proven track record of helping Arizonans overcome their debt challenges. We offer personalized guidance and aggressive representation to achieve the best possible outcome for your situation. Our expertise includes:

- Bankruptcy: We can help you determine if bankruptcy is the right solution for your debt problems. We’ll guide you through the entire process, from filing the paperwork to negotiating with creditors and obtaining a discharge of your debts.

- Debt Settlement: If bankruptcy isn’t the right fit, we can help you negotiate settlements with your creditors. We’ll work to reduce the amount you owe and develop a repayment plan that fits your budget.

- Debt Collection Defense: If you’re being harassed by debt collectors or facing a lawsuit, we’ll defend your rights and fight to protect your assets. We’ll ensure collectors adhere to the law and don’t engage in abusive or unfair practices.

Our Approach

At DebtBusters, we believe in a client-centered approach. We take the time to understand your unique financial situation and goals. We’ll explain your options in plain language, answer all your questions, and develop a personalized strategy to help you achieve financial freedom.

We understand that debt can be a stressful and overwhelming experience. Our goal is to empower you with the knowledge and resources you need to manage your finances and move forward with your life.

Free Consultation: Take the First Step Towards Financial Freedom

If you’re struggling with debt, don’t face it alone. Contact DebtBusters Law Firm today for a free consultation. We’ll review your situation, explain your options, and help you develop a plan to get your finances back on track.

Key Takeaways

Paying a collection agency might seem like a quick fix, but it’s rarely the best solution. Before making any payments, it’s crucial to understand your rights, verify the debt’s validity, and explore all your options.

DebtBusters Law Firm is here to help you navigate the complex world of debt collection in Arizona. We’ll fight for your rights, protect your assets, and guide you toward a brighter financial future. Don’t hesitate to reach out to us for a free consultation. Your financial freedom is within reach.

Top FAQs About Not Paying a Collection Agency

Can a collection agency sue me even if I’m making payments?

Yes, a collection agency can still sue you for the remaining balance of a debt, even if you’re making payments. Paying a debt collector doesn’t automatically stop them from taking legal action.

How long can a collection agency try to collect a debt in Arizona?

In Arizona, the statute of limitations on most debts is six years. This means that if the creditor or collector hasn’t sued you within six years of your last payment, they can no longer take legal action to collect the debt. However, certain debts, like medical debts, may have a shorter statute of limitations.

Can I go to jail for not paying a debt in Arizona?

In most cases, you cannot be sent to jail for failing to pay a civil debt like credit card debt or medical bills. However, you can be held in contempt of court if you fail to comply with a court order related to debt collection, such as a wage garnishment order.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 bankruptcy, also known as liquidation bankruptcy, wipes out most unsecured debts, such as credit card debt and medical bills. Chapter 13 bankruptcy, also known as reorganization bankruptcy, allows you to repay your debts over a three- to five-year period.

How can DebtBusters Law Firm help me?

We offer a free consultation to assess your financial situation and determine the best course of action. We can help you negotiate with creditors, defend you against lawsuits, and file for bankruptcy if necessary. We aim to help you achieve financial freedom and regain control of your life.

Is it better to pay an old debt or let it expire?

It’s generally better to let an old debt expire if the statute of limitations has passed. Paying an old debt can revive it, restart the clock on the statute of limitations, and potentially lead to lawsuits or other collection efforts.

Will paying a collection agency improve my credit score?

Paying a collection agency might not improve your credit score as much as you think. While it can stop further negative reporting, the collection account will remain on your credit report for seven years, impacting your score.

Can I negotiate with a debt collector myself, or do I need an attorney?

You can negotiate with a debt collector yourself, but it’s often advisable to consult with an attorney, especially for large debts or complex situations. An attorney can protect your rights, negotiate on your behalf, and ensure you get the best possible outcome.

What happens if a debt collector sues me in Arizona?

If a debt collector in Arizona sues you, it’s crucial to respond to the lawsuit promptly and seek legal counsel. An attorney can help you defend yourself, negotiate a settlement, or explore bankruptcy as a potential solution.

How does bankruptcy affect my credit score?

Bankruptcy will negatively impact your credit score, but the extent of the damage varies depending on your individual circumstances. It’s important to weigh the potential benefits of bankruptcy against the long-term consequences for your credit.

How long does bankruptcy stay on my credit report in Arizona?

A Chapter 7 bankruptcy will remain on your credit report for 10 years, while a Chapter 13 bankruptcy will stay on your report for seven years. However, you can start rebuilding your credit during and after bankruptcy.

What are the benefits of hiring a bankruptcy attorney in Arizona?

A bankruptcy attorney can guide you through the complex legal process, protect your rights, negotiate with creditors, and help you achieve a fresh financial start. They can also help you determine if bankruptcy is the right option for your situation and advise you on the best type of bankruptcy to file.

How much does it cost to hire DebtBusters Law Firm for bankruptcy?

The cost of hiring a bankruptcy attorney varies depending on the complexity of your case and the type of bankruptcy you file. At DebtBusters, we offer a free consultation to discuss your situation and provide you with a personalized quote.

Does DebtBusters offer payment plans for legal services?

Yes, we understand that financial hardship can make it difficult to pay for legal fees upfront. We offer flexible payment plans and other financing options to make our services accessible to everyone.

What are the specific debt collection laws in Arizona that I should be aware of?

Arizona has its own Fair Debt Collection Practices Act that provides additional protections beyond federal law. Key points include a shorter statute of limitations for some debts (like services rendered) and the requirement for collectors to be licensed and bonded in the state.

Can a debt collector in Arizona take my house or car?

It’s rare for a debt collector to directly take your house or car. However, if they sue you and win a judgment, they can potentially place a lien on your property or garnish your wages, affecting your assets indirectly.

How can I stop debt collectors from contacting me in Arizona?

You can send a written request (certified mail is recommended) to the collection agency asking them to cease communication. They must comply, except for a final notice that they may pursue legal action.

What should I do if a debt collector in Arizona threatens to sue me?

Don’t panic. First, verify if the debt is valid and within the statute of limitations. If it is, consult with a bankruptcy attorney who can help you evaluate your options, including negotiating a settlement or exploring bankruptcy.

What are some common signs of a debt collection scam in Arizona?

Be wary of collectors who demand immediate payment, refuse to provide validation, threaten arrest, or ask for sensitive personal information like your social security number. Legitimate collectors will follow the law and respect your rights.

Can DebtBusters help me with a debt collection lawsuit in Arizona?

Absolutely. DebtBusters Law Firm specializes in debt collection defense and bankruptcy law in Arizona. We can represent you in court, negotiate with the collector, and explore all available options to protect your assets and financial future.

Does paying a collection agency in Arizona remove the debt from my credit report?

No, paying a collection agency doesn’t erase the debt from your credit report. The collection account will typically remain on your report for seven years, marked as “paid collection.” It’s crucial to understand that paying won’t instantly improve your credit score.

What if I can’t afford to pay a collection agency in Arizona?

If you’re struggling to pay a collection agency, you have options. DebtBusters can help you explore alternatives like debt settlement, debt management plans, or even bankruptcy, depending on your specific circumstances.

How does the statute of limitations work for debt in Arizona?

The statute of limitations for most debts in Arizona is six years from the date of your last payment or the date the debt became delinquent. However, certain debts may have a shorter timeframe, such as debts for services rendered (three years).

What are the potential consequences of ignoring a collection agency in Arizona?

Ignoring a collection agency in Arizona can lead to negative consequences, including continued collection efforts, lawsuits, potential judgments, wage garnishment, and damage to your credit score.

Related Content: How Much Does It Cost to File Bankruptcy in Arizona?