The fastest way to pay off debt is to use the avalanche method, which involves focusing on paying off your highest-interest debt first while making minimum payments on the rest. This saves money on interest and accelerates debt elimination.

In addition, here are seven actionable steps to pay off debt fast:

- Evaluate Your Debt: Review balances, interest rates, and payment terms.

- Choose a Payoff Strategy: Try the Debt Snowball (smallest debts first) or Debt Avalanche (highest interest first).

- Consolidate Debt: Combine multiple balances into a lower-interest loan.

- Create a Budget: Track income and expenses to allocate funds toward repayment.

- Cut Expenses: Reduce bills and redirect savings to debt.

- Boost Income: Take on extra work or sell unused items to increase cash flow.

- Explore Debt Relief: Negotiate settlements or file claims to reduce debt.

By following one or more of these steps, you can take control of your finances, eliminate debt faster, and work toward a brighter financial future.

At DebtBusters, we’ve helped countless clients achieve financial freedom using proven strategies to reduce debt quickly and efficiently.

In this article, I’ll explain how to implement this strategy and explore other methods to pay off your debt faster and regain financial freedom.

1. Assess Your Debt Load

Start by assessing the total amount of debt you owe and the interest rates on each debt. Understanding your debt load will help you decide which methods to prioritize, especially if some debts carry higher interest than others.

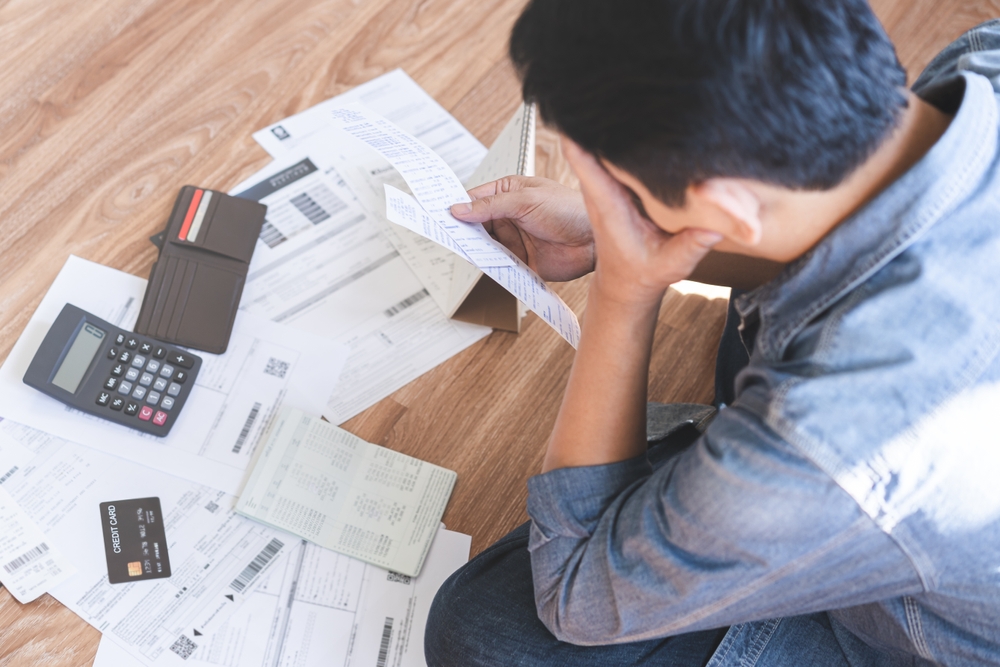

Steps to Assess Debt Load:

- List all outstanding debts, including credit cards, personal loans, and other balances.

- Note the interest rate, monthly payment, and balance for each.

- Identify high-interest debts that may benefit most from quick repayment or consolidation.

Knowing the scope of your debt will provide a clear starting point for choosing the best payoff strategy.

2. DIY Debt Payoff Methods – Debt Snowball or Debt Avalanche

DIY debt payoff methods, like the Debt Snowball and Debt Avalanche, help you pay down debt in a structured, motivating way.

Debt Snowball Method: Focus on paying off the smallest debt first, then roll that payment into the next smallest debt, creating a “snowball” effect.

Debt Avalanche Strategy: Focus on paying off debts with the highest interest rates first, helping you save more money in the long run.

Comparing Debt Snowball vs. Debt Avalanche

| Method | Focus | Best For | Drawbacks |

|---|---|---|---|

| Debt Snowball | Smallest balance first | Quick wins and motivation | May cost more in interest |

| Debt Avalanche | Highest interest rate first | Saving on interest | Slower initial progress |

Choose the method that best aligns with your goals—whether it’s saving on interest or seeing results quickly.

3. Consider Debt Consolidation for Faster Payoff

A debt consolidation loan streamlines repayment by merging several high-interest debts into one loan with a lower interest rate, typically offering a fixed monthly payment. This option can reduce your total interest expense and help you pay off debt faster.

Key Considerations:

Eligibility: A good credit score can help you qualify for competitive rates.

Choosing a Lender: Compare options from banks, credit unions, and online lenders.

The Pros and Cons of Debt Consolidation Loans

| Pros | Cons |

|---|---|

| Lower interest rate | Requires good credit |

| Simplified, single payment | May involve fees |

| Fixed monthly payment | Could extend repayment term |

Debt consolidation may not be right for everyone, but it’s especially helpful for those dealing with high-interest debt who qualify for low-rate loans.

4. Boost Debt Payoff with Budgeting

Creating a budget provides the structure you need to allocate more money toward debt repayment. By tracking income and expenses, you can identify areas where spending can be reduced to pay down debt faster.

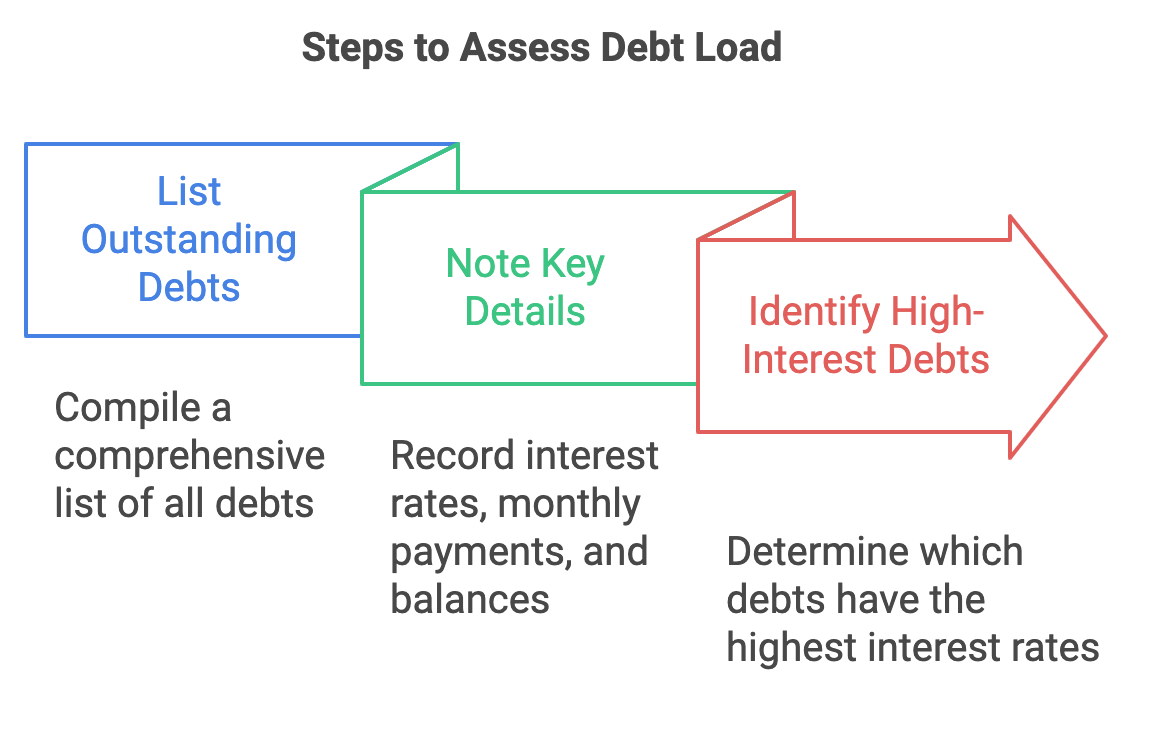

Steps to Set Up a Budget:

- List all sources of income and fixed monthly expenses (rent, utilities, groceries).

- Identify flexible expenses like dining out and entertainment.

- Allocate a set amount for debt repayment each month based on any surplus funds.

Using budgeting tools like Mint or YNAB (You Need A Budget) can simplify this process and help you stay on track with debt repayment.

5. Lower Your Bills and Use the Savings for Debt Repayment

Cutting back on monthly bills can free up extra money to put toward your debt. This strategy is especially useful for those who want to increase their debt payoff amount without taking on extra work.

Ways to Lower Bills:

- Negotiate lower rates with service providers (e.g., internet, insurance).

- Switch to lower-cost subscriptions or cancel unused services.

- Practice energy-saving habits to reduce utility bills.

Directing these savings toward your debt can help you make faster progress without impacting other areas of your budget.

6. Increase Your Income to Pay Down Debt Faster

If you’re looking to pay off debt quickly, consider taking on a temporary side job or freelance work. By directing all extra income solely toward debt repayment, you can make significant progress.

Ideas for Side Hustles:

- Freelance services (e.g., writing, design, tutoring).

- Selling unused items online.

- Part-time work with flexible hours.

Increasing your income through short-term work provides flexibility and helps you tackle debt more aggressively, especially if you want to close out smaller balances quickly.

7. Explore Debt Relief Options

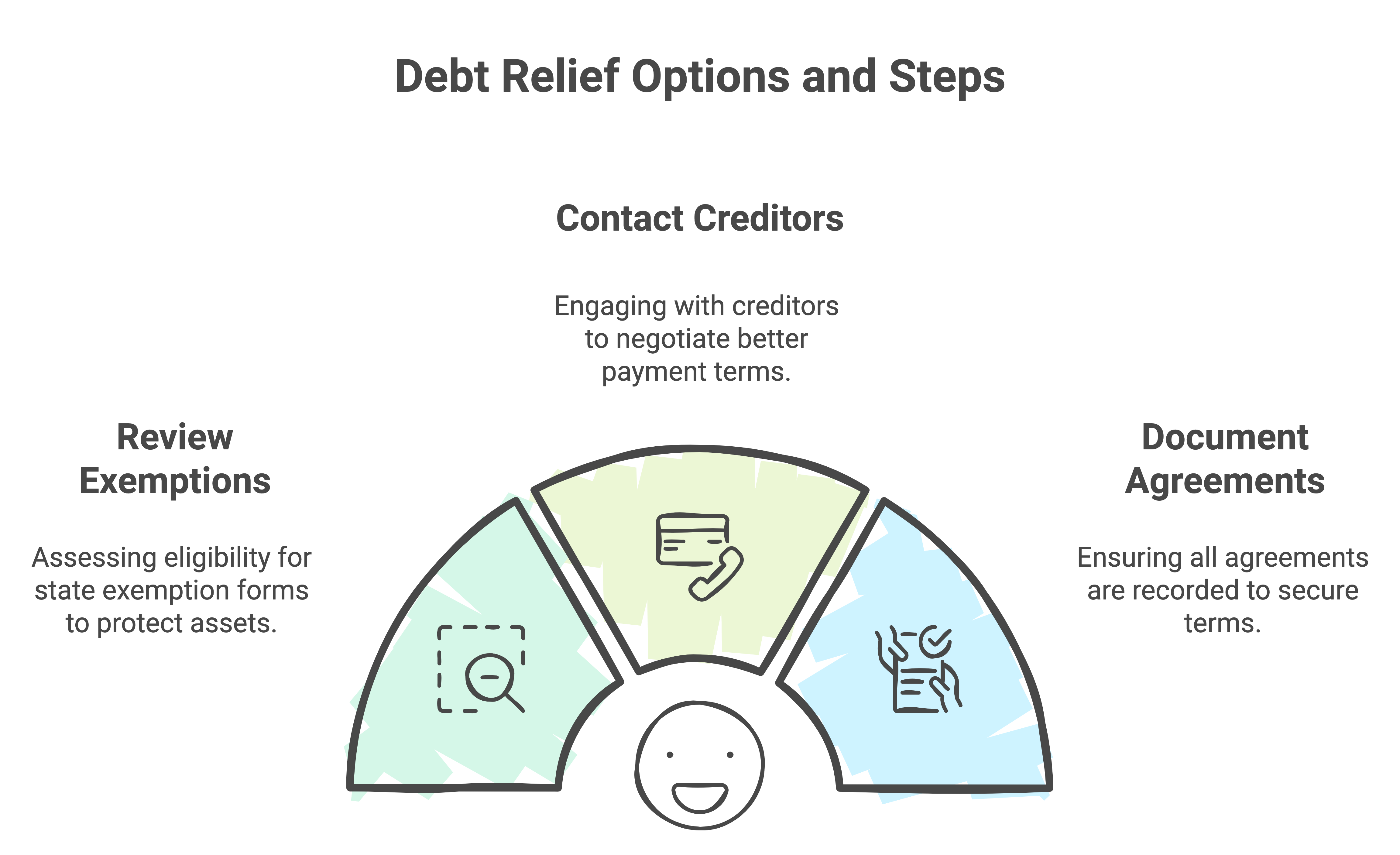

Debt relief options, such as filing a Claim of Exemption or negotiating a debt settlement, can be effective for those facing financial hardship.

Claim of Exemption: Some state laws allow you to claim a portion of your income as exempt from wage garnishment. Check your state’s rules to see if you qualify.

Debt Settlement: Negotiate with creditors to accept a reduced lump sum to settle the debt, which can reduce your debt balance significantly if successful.

Steps to Consider for Debt Relief Options:

- Review state exemption forms and determine eligibility.

- Contact creditors to explore the potential for debt settlement or reduced payments.

- Document any agreements in writing to ensure terms are honored.

These options are best for individuals struggling with financial hardship and unable to pay debts through conventional methods.

Comparing Debt Payoff Strategies

Each debt payoff strategy offers unique benefits, and the best choice depends on your financial goals, debt amount, and personal situation.

To help you determine the right approach, the table below summarizes the key features of each method, including who they’re best suited for and the main advantages of each. Use this as a quick reference to decide which strategies might work best for you.

| Method | How It Works | Best For |

|---|---|---|

| Assess Debt Load | Review all debts and rates | All types of debt |

| Debt Snowball or Avalanche | Pay smallest debt first or highest interest | Motivation or interest savings |

| Debt Consolidation Loan | Combine debts into one loan | High-interest debt, multiple creditors |

| Budgeting | Track and allocate funds to debt | All types of debt |

| Lowering Bills | Reduce monthly expenses | Flexible spending adjustments |

| Increase Income | Earn extra money for debt | Flexible schedules, short-term goals |

| Debt Relief Options | Claim exemptions, negotiate settlement | Financial hardship, wage garnishments |

Take the First Step Toward a Debt-Free Future

Paying off debt quickly can regain control over your finances and eliminate financial stress. By choosing one or more of these strategies, you’ll be well on your way to achieving a debt-free future.

If you’re ready to take charge of your debt, contact DebtBusters at (866) 223-4395 for a free no-obligation consultation with personalized debt solutions and expert support. Let’s start your journey to financial freedom today.

Frequently Asked Questions

What is the fastest way to pay off debt?

The fastest way to pay off debt depends on your financial situation, but a combination of budgeting, the Debt Avalanche method (paying high-interest debt first), and increasing your income with a side job can be highly effective. Consider consolidating high-interest debt into a lower-interest loan to reduce interest costs and speed up payoff.

How does the Debt Snowball method work, and is it effective?

The Debt Snowball approach focuses on paying off your smallest debts first while maintaining minimum payments on all other debts. Once a debt is paid, you roll that payment into the next smallest debt, creating momentum. This method is effective for people who are motivated by seeing quick progress, even though it may result in paying more interest overall.

Is debt consolidation a good idea?

Debt consolidation can be a great option if you have multiple high-interest debts. By consolidating them into one loan with a lower interest rate, you simplify payments and potentially save on interest. It’s best suited for those with a good credit score who qualify for low-rate loans. However, extending the loan term could mean paying more interest over time.

What is a Claim of Exemption, and how can it help with debt?

A Claim of Exemption is a legal filing that protects a portion of your income from wage garnishment, especially if garnishment prevents you from meeting basic needs. Eligibility and protections vary by state, so check local laws or consult a legal expert. Filing a Claim of Exemption can reduce or halt wage garnishment, allowing you to retain more of your income.

How does a balance transfer card help reduce debt?

A balance transfer card with a 0% introductory APR allows you to move high-interest credit card debt to a card with no interest for a promotional period, typically 12-18 months. This can save you significant interest if you pay off the balance before the period ends. Be mindful of transfer fees and high interest rates after the promo period.

Can negotiating with creditors reduce my debt?

Yes, negotiating with creditors can reduce your debt. Creditors may be open to lowering your interest rate, reducing the balance, or setting up a payment plan if they believe it will help them recover funds. This approach works best if you can show financial hardship and have a realistic proposal for repayment.

Should I prioritize saving or paying off debt?

For most people, paying off high-interest debt should be prioritized over saving, as high-interest costs often outweigh the benefits of typical savings rates. However, keeping a small emergency fund is also essential to avoid further debt in unexpected situations. Once high-interest debt is paid off, focus more on building savings.

What’s the difference between Debt Avalanche and Debt Snowball methods?

The Debt Avalanche approach prioritizes paying off debts with the highest interest rates first, reducing the total interest paid over time. The Debt Snowball method, on the other hand, targets the smallest debts first to build momentum. Choose Debt Avalanche if you want to save the most money over time, and Debt Snowball if quick wins will keep you motivated.

How does increasing my income help with debt repayment?

Increasing your income, even temporarily, gives you extra funds that you can directly apply to your debt. Options like freelance work, selling unused items, or part-time jobs allow you to make additional payments and reach debt freedom faster. Using all extra earnings toward debt reduces the repayment period and total interest paid.